Mini Nuclear Reactors (SMRs): Deep Dive into Key Players, Tech & Market Trends

Sector Overview: Resurgence of Small Reactors and the AI Energy Wave

Read the full research paper: https://chatgpt.com/s/dr_68dcf14419c4819199764af2beca8cd3

Small modular reactors (SMRs) and microreactors – essentially “mini” nuclear power plants – are gaining momentum as a carbon-free energy solution. In the past year, investor enthusiasm has surged due to rising electricity demand from AI data centers and favorable policies supporting nuclear energy. (prnewswire.com).

For example, a recent U.S. deal will deploy up to 6 GW of new SMR capacity in the Tennessee Valley Authority region, enough to power “60 new data centers” amid unprecedented demand from AI and tech industries. (prnewswire.com).

Tech giants are jumping in: Amazon plans to deploy 5 GW of nuclear power by 2039 through a partnership with X-energy and utility Dominion, and Google is working with Kairos Power to add hundreds of megawatts from advanced reactors. This convergence of AI-driven energy needs, climate goals, and supportive policy (streamlined licensing, fuel supply initiatives, tax credits) has created a nuclear hype wave in 2024–2025. From the U.S. to Europe, governments are pumping money into SMRs. The U.K. has set a goal of 24 GW of new nuclear by 2050 and launched a competition to choose an SMR design. As of mid-2025, the U.K. selected Rolls-Royce’s SMR as the preferred technology and committed an estimated £2.5 billion in funding support. Similarly, the U.S. Department of Energy (DOE) is backing multiple advanced reactor demonstrations with multi-billion cost-sharing, while also tackling the supply of high-assay low-enriched uranium (HALEU) fuel needed for many designs. Recent executive orders have even directed the NRC to “streamline regulations and fast-track new licenses” for reactors. In short, the stage is set for a new generation of nuclear startups – but turning hype into profitable reality is the big challenge. Below we analyze the key companies in the mini-reactor sector – their technology, timelines, funding, partnerships – and scrutinize recent market performance and risks. (We focus on companies investable now via public markets, but also cover prominent private players shaping the landscape.) NuScale and Oklo get extra attention given their high-profile status and volatility. We then rank which ventures are closest to revenue and which face steep hurdles like dilution or regulatory roadblocks, cutting through the optimism with a sober look at risks.

NuScale Power (NYSE: SMR) – Light-Water SMR Pioneer with First-Mover Edge

Rendering of an advanced NuScale SMR plant. NuScale’s VOYGR facility houses multiple small reactor modules (Image: NuScale Power) NuScale is a U.S. leader in SMRs and notably the first (and so far only) to receive U.S. NRC design certification for its reactor. Its technology is a factory-fabricated light-water reactor module producing 77 MWe each (recently uprated from 50 MWe). Up to 12 modules can be combined into one plant for scalable capacity. NuScale’s design emphasizes passive safety – the modules sit in a submerged pool and can self-cool without power. This head start in licensing gives NuScale a “clear competitive advantage” and it enjoys backing from engineering giant Fluor Corp. (which owns a majority stake), providing deep pockets and EPC expertise. Timeline & Projects: NuScale is targeting its first operational units by late this decade. It secured agreements to deploy six modules (462 MWe) in Romania by 2028–2030. (trefis.com).

and is working with a U.S. utility consortium (UAMPS) on a first plant at the Idaho National Lab site (now planned as 6 modules online ~2029). A major vote of confidence came in August 2025 when TVA and partner ENTRA1 announced a landmark plan for up to 6 GW of NuScale SMR capacity across the U.S. Southeast – “the largest SMR power commitment in U.S. history”. (prnewswire.com).

This program envisions six SMR plants supplying TVA’s grid, enough for 4.5 million homes. (prnewswire.com).

While still an early-stage agreement, it underscores NuScale’s frontrunner status in domestic nuclear expansion. Internationally, NuScale has additional MOUs (e.g. Poland, Kazakhstan) and interest from other countries following Romania’s lead. Funding & Financials: Thanks to Fluor’s support and its 2022 SPAC IPO, NuScale is capitalized for now. It ended Q2 2025 with a cash balance of $489.9 million after raising funds via its NYSE listing (ticker SMR). The company has begun to generate modest revenue from engineering services – $8.1 million in Q2 2025, up from just $1.0 million a year prior – reflecting early progress on commercial orders. Net losses remain significant (Q2 net loss of ~$0.13/share) as NuScale invests in supply chain and manufacturing setup. The DOE has committed hefty cost-share funds (up to $1.4 billion for the Idaho project) and recently is even helping secure HALEU fuel for NuScale’s reactors. These non-dilutive supports are crucial given the high cost of bringing a first-of-kind SMR to market. Market Performance: NuScale’s stock has been on a rollercoaster ride, emblematic of the nuclear hype. Over the last 6–12 months, SMR shares rocketed roughly 200 %, vastly outperforming the broader market. Investor optimism peaked in mid-2025 as NuScale hit milestone after milestone – NRC approval of its uprated design, that massive TVA/ENTRA1 deal, and broad political tailwinds. The stock surged from the mid-$10s into the $30–40+ range, at one point up 250 %+ year-to-date. In late September 2025 it traded around $38, after a brief spike above $40. Notably, NuScale jumped ~25 % in early September on the TVA 6 GW news alone, showing how sensitive it is to big contract announcements. However, with the stock’s rapid appreciation, Wall Street has grown more cautious on valuation. The consensus rating recently slipped to “Hold” and the average analyst 12-month price target is ~$37, essentially at the current price. (marketbeat.com).

In other words, a lot of good news is already priced in. Any delays in converting MOUs to firm orders could prompt pullbacks. Outlook & Risks: NuScale is arguably closest to revenue among pure-play SMR developers, but it still faces a long road to positive cash flow. The company hopes to secure its first definitive reactor order by end of 2025 – a critical catalyst. Execution risk is high: building the first plants by 2028–30 will test NuScale’s cost estimates and supply chain. Any slippage could “hit revenue” projections and spook investors. Likewise, the market adoption may be gradual; utilities tend to be conservative in embracing new reactors, and competition is rising (from GE Hitachi’s proven design, etc.). As a pre-profit company, NuScale will likely need to raise additional capital or bring in strategic investors within a couple of years – raising the specter of share dilution if done at lower prices. On the bright side, its first-mover licensing advantage, strong backing (Fluor, DOE) and multiple projects in the pipeline position NuScale as a potential long-term winner in a revived nuclear industry. It’s a classic high-risk, high-reward story: NuScale’s ~$2.2 billion market cap bets on it capturing a significant slice of the future SMR market, but investors should remain cautious of near-term volatility and execution hurdles.

Oklo Inc. (NYSE: OKLO) – Altman-Backed Microreactors Riding the AI Boom

Concept rendering of Oklo’s Aurora microreactor with its distinctive A-frame housing. Oklo’s design is compact and meant to be an attractive community hub, not a traditional industrial plant (Image: Oklo) (newatlas.com) (newatlas.com). Oklo is a Silicon Valley-born startup developing ultra-compact reactors, and it has become the hottest name in advanced fission this year. Oklo’s claim to fame is its Aurora “powerhouse”, a very small fast-spectrum reactor that uses metallic HALEU fuel and heat-pipe cooling. Originally a 1.5 MWe microreactor concept, Aurora has been scaled up to 15 MWe and even a 50 MWe variant in development. The unit is housed in an A-frame style building (resembling a cozy alpine lodge) with an integrated supercritical CO₂ generator – a far cry from conventional concrete domes. Each Aurora can run 10–20 years without refueling. Oklo’s business model is to build, own, and operate these reactors and sell energy “as-a-service”, rather than selling the reactors themselves. By recycling used nuclear fuel as input, Oklo also pitches itself as helping solve nuclear waste while producing power. This edgy vision attracted OpenAI CEO Sam Altman, who has been Oklo’s chairman and lead backer since 2015. Timeline & Progress: Oklo aims to deploy its first commercial Aurora unit by 2027–2028. It’s already secured a site at Idaho National Lab and even broke ground on pre-construction activities. The target is to have that inaugural 15 MWe reactor online supplying customers by late 2027 (an aggressive schedule). However, Oklo must still obtain a combined license from the NRC. Its initial license application (for a 1.5 MWe design) was denied in 2022 due to gaps in the submission, so Oklo is regrouping with its larger design and a fresh application likely in 2024–25. Regulatory risk is thus front and center – but the company is working closely with authorities and even brought in Korea’s KHNP as a partner to refine its design and licensing approach. (world-nuclear-news.org).

Despite being pre-commercial, Oklo has lined up a remarkable customer pipeline. In late 2024 it signed one of the largest power purchase deals in history: a framework with data center developer Switch, Inc. to deploy up to 12 GW of Aurora reactors by 2044. This deal, though non-binding, underscores the massive interest from the tech sector in nuclear power. Oklo will aim to gradually install dozens (eventually hundreds) of microreactors to supply Switch’s facilities, with the first units later this decade. Likewise, the U.S. Air Force selected Oklo for a 30-year contract to build a 5 MWe microreactor at Eielson AFB, Alaska – the military’s first such project – pending regulatory approval. (airandspaceforces.com) (world-nuclear-news.org).

Oklo has also inked an MOU with Korea Hydro & Nuclear Power (KHNP) to collaborate on manufacturing and global deployment of Aurora units (leveraging KHNP’s construction experience). (reuters.com) (world-nuclear-news.org).

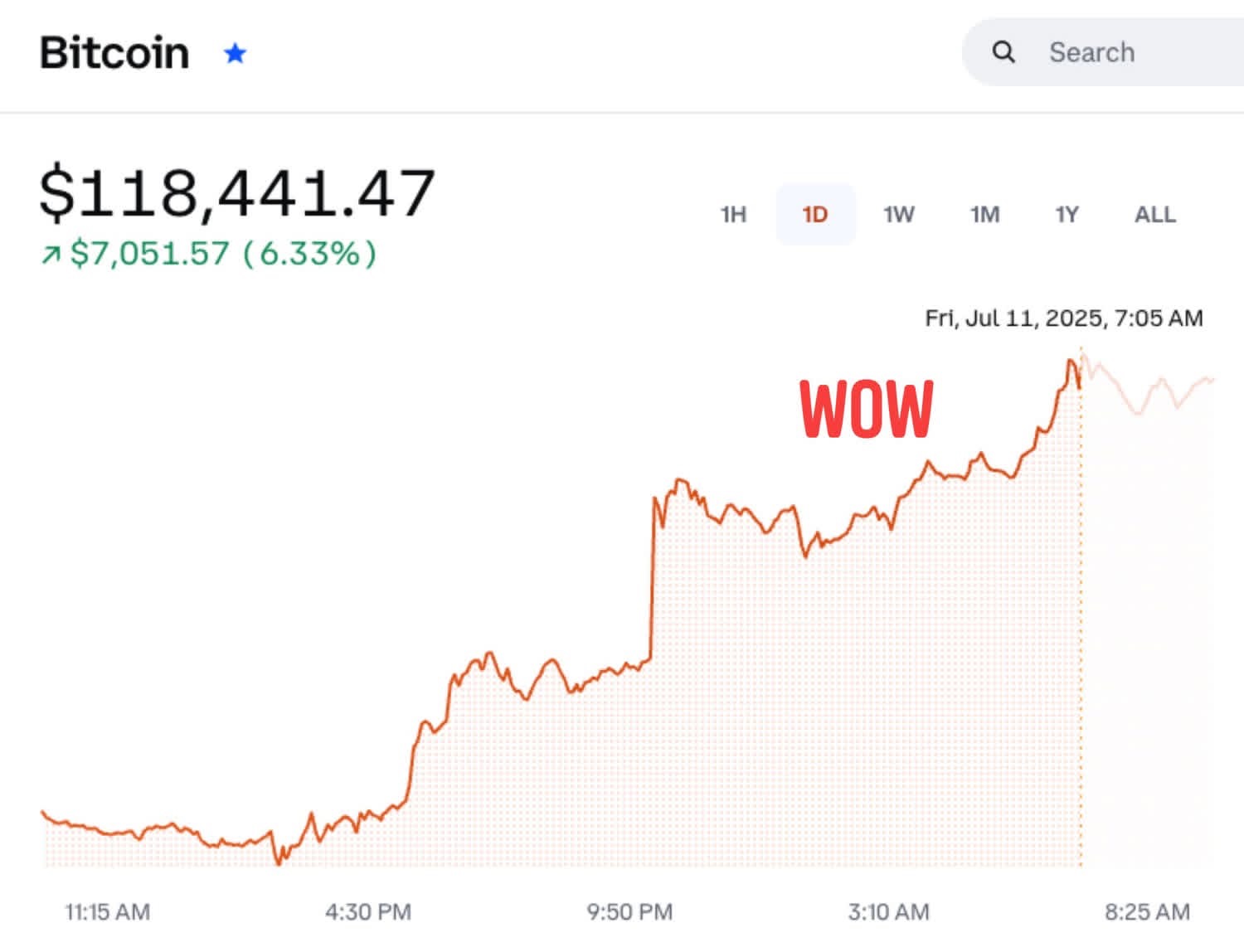

All told, Oklo reported a potential customer pipeline of 2,100 MW for its reactors as of late 2024. If even a fraction of this converts to revenue, Oklo could scale rapidly – but it has a lot to prove first, including actually building one. SPAC Merger, Funding & Partnerships: In May 2024, Oklo went public via a SPAC merger (sponsored by Sam Altman’s AltC Acquisition Corp), raising about $306 million in gross proceeds for the company. The SPAC deal valued Oklo at ~$850 million pre-money. Post-merger, Altman and existing shareholders rolled their equity, and Oklo began trading on the NYSE under ticker OKLO. The timing was fortuitous – just as investor appetite for AI-adjacent nuclear plays exploded. With Altman’s high profile and the narrative of “nuclear batteries to power AI”, Oklo attracted intense market interest. It doesn’t hurt that Oklo’s approach is unconventional (fast reactors, recycled fuel) and therefore carries an aura of “next-gen tech” in an industry known for conservatism. Beyond Switch, Air Force, and KHNP, Oklo has partnerships for fuel and supply chain. It plans to build a fuel recycling facility at INL to produce its own metallic fuel from spent nuclear fuel. Oklo also partnered with Argonne National Lab on fuel testing, and received DOE awards for work on HALEU fuel recycling. These partnerships are about de-risking the tech. Importantly, Oklo’s model of long-term power sale contracts (like the Switch PPA and Air Force PPA) should help it finance projects with predictable cash flows rather than rely on customers to buy reactors upfront. This is a novel approach in nuclear and aligns with how large tech firms procure renewable energy. Stock Volatility: Oklo’s stock performance has been nothing short of astounding. In its May 2024 debut, OKLO plunged ~54 % on day one to $8.45 (from the SPAC’s prior ~$14 price) as pre-deal enthusiasm reset. But from that initial trough, Oklo went on a breathtaking rally. Over the next year, shares skyrocketed over 1,100 %, making Oklo a 10-bagger and one of the market’s top performers. By September 2025, the stock was trading around $110, up ~420 % just in 2025 alone. At one point it hit an intraday high near $130, giving Oklo a fully diluted market cap around $16 billion – an extraordinary valuation for a company with no revenue yet. What drove this mania? In a word, hype – Oklo became the poster child for the “AI needs nuclear power” story and a meme-stock among those bullish on clean tech. Every new partnership announcement (Switch’s 12 GW, the Air Force deal, etc.) and each pro-nuclear policy headline seemed to send the thinly traded stock higher. However, volatility is extreme. In late September, Oklo stock pulled back ~18 % in a week amid a wave of insider selling and the first major Wall Street rating. (coincentral.com).

Several insiders (including the CEO, CFO, and board members) sold chunks of shares, which, while planned, spooked the market. (coincentral.com).

Then Goldman Sachs initiated coverage with a neutral rating and a $117 price target, cautioning that Oklo’s valuation had “run far ahead of fundamentals” and flagging its unproven technology and long road to revenue. This one-two punch of insider sales and sober analyst commentary punctured some of the hype. Even after the dip, Oklo remains up over 1000 % year-on-year, so sentiment could swing wildly on any news. In short, Oklo has become highly speculative, trading more on story than substance at this stage. Outlook & Risks: There’s no denying Oklo’s bold vision and the massive upside if it executes (the Switch deal alone, if fully realized, implies hundreds of reactors and steady cash flows). Oklo is also relatively well-funded post-SPAC and has an enviable roster of allies. But investors must grapple with fundamental risks: no reactor is built yet, no NRC license in hand, and no revenue likely until 2027+. Oklo will burn cash on development and could need to raise more capital if timelines slip – raising dilution risk down the line. The regulatory hurdle is significant: Oklo’s fast reactor is a new type for the NRC, and the company will need to convincingly demonstrate safety to avoid the fate of its first application. Execution risk is high too; building a first-of-kind microreactor by 2027 is a tight schedule, and any delays could erode the market’s patience given the current lofty valuation. Furthermore, Oklo’s stock now prices in heroic outcomes. As Goldman noted, enthusiasm has been “catalyst-driven” – meaning if anticipated catalysts (like a permanent license, a new big contract, etc.) are delayed or disappoint, the stock could see sharp corrections. In essence, Oklo offers huge upside potential (it aspires to be a profitable nuclear utility selling power across sectors) but comes with equally huge execution and valuation risk. It’s a long-term bet that today’s nuclear renaissance truly materializes – and that Oklo will be one of its first big winners.

TerraPower – Private Fast Reactor Venture with Gigantic Backing (Bill Gates)

TerraPower is a heavyweight in advanced nuclear, founded by Bill Gates and a cadre of scientists in 2006. While not publicly traded, it’s on every nuclear investor’s radar given its cutting-edge Natrium reactor and deep funding. Natrium is a 345 MWe sodium-cooled fast reactor paired with an innovative molten salt heat storage system – it can flex its output to 500 MWe for peak periods by dumping heat from the salt storage to a steam generator. (powermag.com) (powermag.com).

This design, co-developed with GE Hitachi, aims to marry nuclear reliability with grid flexibility (load-following). TerraPower is also pursuing a molten-chloride fast reactor and has a medical isotopes division, but Natrium is its flagship. Timeline & Demo Project: TerraPower, in partnership with utility PacifiCorp, is building a Natrium demonstration plant in Kemmerer, Wyoming, at the site of a retiring coal plant. Initially the target was to have it running by 2028, but a major setback hit: the specialized HALEU fuel for Natrium was supposed to come from Russia. After Russia’s invasion of Ukraine, that supply was cut off, and domestic HALEU production is only just ramping up. As a result, TerraPower announced a roughly 2-year delay to 2030 for the demo plant launch. (powermag.com).

Despite this, TerraPower began early construction activities (non-nuclear infrastructure) in 2022–2023, and by 2024 it submitted its construction permit application to the NRC. (powermag.com).

Licensing is reportedly on track, and TerraPower remains confident the Kemmerer reactor will operate by 2030. (reuters.com).

The company is actively working on the HALEU issue – for instance, the DOE awarded contracts to enrichers like Centrus to domestically produce HALEU, and initial batches are expected by mid-decade. Funding & Partnerships: TerraPower is funded like a tech unicorn. It raised an $750 million round in 2022 (led by Gates and SK Group of Korea), on top of earlier funding, and importantly it won a $1.9 billion ARDP award from the U.S. DOE. (powermag.com).

Under this cost-share, DOE picks up half the Natrium demo cost – a huge subsidy. The project’s engineering, procurement, and construction is being handled by Bechtel, a top nuclear EPC firm (which provides experience in managing such a first-of-a-kind build). GE Hitachi is a key technology partner (their PRISM reactor knowledge underpins Natrium). Also noteworthy: PacifiCorp (owned by Buffett’s Berkshire Hathaway) is the utility hosting the demo and potentially ordering more if it succeeds. This partnership with a major utility signals that Natrium isn’t just a science project – it has an end-customer viewpoint integrated. TerraPower has branched into other partnerships as well. It has an MOU with Wyoming’s state government (hence choosing a Wyoming site), agreements in Japan for sodium technology cooperation, and is actively lobbying for federal support on fuel. TerraPower’s separate program, the Molten Chloride Reactor Experiment (MCRE) with Southern Company, recently achieved operation at Idaho Lab, marking the first fission in a molten salt reactor in the U.S. – although small, it’s a stepping stone for their future designs. These side efforts diversify TerraPower’s tech portfolio (e.g., exploring reactors for industrial heat or maritime use as hinted by the company. (powermag.com)). Status: As a private company, TerraPower’s financials aren’t public, but it’s clearly in R&D mode – spending heavily on Natrium development and fuel cycle. It will rely on continued support from Gates (who has publicly said he’ll fund whatever it takes) and government grants to reach completion. With the demonstration plant scheduled by 2030, revenue from selling power or additional reactors won’t flow until next decade. However, TerraPower could see near-term revenue from selling medical isotopes (it’s building facilities to produce cancer-treatment isotopes like actinium-225). Gates and co. likely view these ventures as long plays that will pay off in the 2030s when advanced reactors are commercial. Big Picture: TerraPower’s Natrium is one of the most advanced Gen-IV reactor projects globally, and its success or failure will heavily influence the future of fast reactors. For investors, TerraPower isn’t directly accessible via stock yet. But one can get indirect exposure through SK (South Korea) which took a stake, or simply by investing in the nuclear supply chain companies that TerraPower contracts (like Centrus Energy for fuel, or maybe GE Hitachi’s owners). TerraPower’s risks are largely technical and geopolitical: ensuring the sodium reactor works as intended, and securing enough fuel in time. The company’s optimism is high – TerraPower said construction is on a “predictable schedule” with “construction complete in 2030”. (powermag.com) (powermag.com).

Importantly, TerraPower already started groundwork at the Wyoming site and even built a test facility for full-size components and sodium handling. (powermag.com).

This indicates a serious execution push. If it hits 2030 on target, TerraPower will have the first grid-scale advanced reactor in the U.S., potentially unlocking orders worldwide for similar plants. But if delays stretch on (e.g. fuel bottlenecks unresolved or cost overruns), it could dampen the broader advanced nuclear renaissance. In sum, TerraPower is a high-impact venture – not one you can buy stock in today, but one that any nuclear sector investor should monitor closely.

X-energy – High-Temperature Modular Reactors with Big Deals (Private, Plan to Go Public)

X-energy is another U.S. advanced reactor firm making waves, focused on HTGR (High-Temperature Gas-cooled Reactors). Its signature design, the Xe-100, is an 80 MWe pebble-bed reactor that can be deployed in packs of four (4×80 MWe = 320 MWe plant). The Xe-100 uses TRISO fuel (tiny uranium fuel pebbles encapsulated for safety) and outputs high-temperature heat (~600°C) in addition to power, making it useful for industrial processes or hydrogen production. X-energy has strong government support: it was a co-winner of the DOE’s ARDP demo funding (awarded ~$1.2 billion) to build four Xe-100 units in Washington state by 2030. Timeline & Projects: The ARDP demonstration is in collaboration with Energy Northwest (a consortium of utilities) and is slated for the Hanford site in Washington, aiming for operation around 2028–2030. X-energy hit a licensing milestone in March 2025 by submitting a Construction Permit application to the NRC for its first unit(s). The NRC has since docketed the application and even set an accelerated 18-month review schedule – notably cutting the typical timeline in half. This indicates urgency and support to get X-energy’s project moving. However, it’s reported that Dow, X-energy’s major private-sector partner, likely won’t give a final go-ahead on building the plant until 2028 after seeing more progress. That partner is Dow Inc., the chemical industry giant. In 2022, X-energy and Dow announced plans to deploy a four-pack of Xe-100 reactors at one of Dow’s Gulf Coast manufacturing sites (in Seadrift, Texas) to provide process heat and power. This is a groundbreaking project – using an SMR to directly drive an industrial facility’s needs. In June 2025 the NRC also accepted the construction permit application for this Dow/X-energy plant. The goal is to have it running by around 2030. If successful, it could kick off a fleet of SMRs for industrial decarbonization. X-energy also landed a headline-grabbing deal with Amazon in 2024. Amazon, along with utility partner Constellation and X-energy, announced plans to develop up to 5 GW of nuclear power by 2039 to supply Amazon’s operations. As part of this, Amazon is investing (through a fund or partnership) to help deploy X-energy reactors. The first phase likely involves a few Xe-100 plants (the 5 GW figure might include many units over time). This was announced alongside Amazon signing a PPA with Constellation to keep an existing Illinois nuclear plant online. (powermag.com).

showing Amazon’s multi-pronged nuclear strategy. The Amazon-X-energy partnership underscores how demand for clean energy from tech firms is catalyzing SMR projects. Additionally, X-energy has an agreement with Dominion Energy (a major utility) to look at SMRs for Virginia, and an MOU with Ontario Power for potential deployments in Canada. Internationally, it’s exploring opportunities in places like Romania and Jordan for its reactor, though those are in early stages. Funding & Path to Public Market: X-energy has raised substantial private capital (from investors like Venture capital funds and corporate partners). It had planned to go public via a SPAC merger with Ares Acquisition Corp in 2023 at a $2 billion valuation. However, by late 2023 that SPAC deal was mutually terminated amid challenging market conditions for new listings. Instead, X-energy reportedly secured about $120 million in private financing as a bridge in early 2024 to carry on operations. The company still intends to pursue a public listing when conditions improve (possibly via another SPAC or IPO in 2025). So for now, it’s not directly investable, but one can watch for it in the near future. Financially, X-energy will need significant capital to build its projects – the ARDP demo cost is on the order of $2.5 billion (half to be covered by DOE). Likewise, the Dow project will be capital intensive. The partnership model (with Dow, with Amazon/Constellation) hints that those end-users may finance the reactors with X-energy providing the technology and fuel, rather than X-energy shouldering full project costs. X-energy also owns TRISO-X, a subsidiary building a TRISO fuel fabrication facility in Tennessee. This is crucial for its fuel supply and could become a revenue stream if it sells TRISO fuel to other reactor operators in the future. Outlook & Risks: X-energy has positioned itself as a leader in the high-temperature reactor niche, which complements what NuScale and GE Hitachi are doing with water-cooled SMRs. Its MOUs with industrial users (Dow) and data center operators (Amazon) give it a strong story: these reactors can serve markets beyond just utilities. If all goes to plan, X-energy’s first reactors will be operating by the end of this decade, and it could ramp up production in the 2030s. The risks are typical of an advanced reactor startup: technology (the Xe-100 is new, though based on proven pebble-bed concepts), licensing (NRC must approve everything, albeit early signs are good with the fast-track review), and funding (the collapse of the SPAC means X-energy must rely on private funding a bit longer; it will need more equity or partner money to reach commercialization). From an investment perspective, the termination of the SPAC was a setback, but also maybe a blessing – it avoided going public in a weak market. When X-energy does list, it will bring a significant pipeline (multiple units for Dow, the government demo, Amazon’s commitment) – arguably one of the more concrete order books in the SMR space. Like others, it won’t be profitable until reactors actually get built and sold, likely well into the 2030s. But given its strategic partnerships and the urgency for industrial decarbonization, X-energy is definitely one to watch as the sector matures.

Rolls-Royce SMR – The U.K.’s Contender (Rolls-Royce Holdings plc)

Rolls-Royce SMR is a subsidiary of the famed British engineering firm Rolls-Royce plc (LSE: RR., also traded as RYCEY in the U.S.). While Rolls-Royce is known for jet engines, it has decades of nuclear expertise (they build reactors for the Royal Navy’s submarines). Leveraging that know-how, Rolls spun up an SMR division in 2017 to design a 470 MWe pressurized-water reactor. This SMR uses proven PWR technology but packaged in a compact, factory-fabricated format. Each plant would produce ~1 GW thermal / 470 MW electric and run for 60+ years. (world-nuclear-news.org).

It’s on the larger end of “SMR” scale, but the strategy is to maximize output while still enabling modular construction. Funding & Government Support: Rolls-Royce SMR received £210 million in U.K. government grants in 2021 and raised £280 million from private investors (including Qatar’s sovereign fund, U.S. Exelon, etc.). This £490 M funded the design through the basic design phase and the Generic Design Assessment (GDA) process with U.K. regulators. As the program advanced, it became clear that much more capital will be needed to actually deploy plants. The U.K. government recently made a landmark commitment: in June 2025 it selected Rolls-Royce SMR as the “preferred bidder” in its SMR competition, earmarking roughly £2.5 billion to support the first rolls-out of Rolls SMRs. Under the plan, Great British Energy (a new government-backed entity) will form a joint venture with Rolls to build the first set of at least three SMR units in the U.K. (world-nuclear-news.org) (world-nuclear-news.org).

The goal is to have the first unit operational by the early 2030s (grid connection in mid-2030s and a final investment decision by 2029). (world-nuclear-news.org) (world-nuclear-news.org).

This huge funding injection essentially guarantees a domestic market for Rolls’ SMRs and is intended to catalyze a fleet. Rolls-Royce SMR has stated that deploying just three units in the U.K. will create thousands of jobs and significant industrial regeneration. (world-nuclear-news.org) (world-nuclear-news.org).

Beyond the U.K., export opportunities are a big part of the thesis. Rolls has MOUs or interest from ~10 countries. Notably, ČEZ in the Czech Republic selected Rolls’ SMR for up to 3 GW of new nuclear (around 6 units). (world-nuclear-news.org).

Rolls is also shortlisted in the Netherlands and was in Sweden’s recent SMR considerations. (world-nuclear-news.org).

Having U.K. government backing strengthens Rolls’ hand in these international competitions. The company also partnered with Fortum in Finland for feasibility studies, and with U.S. reactor vendors (for example, working with MWM/KNDS on heavy component manufacturing). Interestingly, Rolls-Royce SMR inked a deal with Turkey’s ENKA to jointly approach projects in Eastern Europe, and it is exploring possibilities in Asia and the Middle East. If all goes well, Rolls envisions selling dozens of its SMRs globally. Technology & Status: Rolls’ design is currently in Phase 2 of the U.K.’s GDA regulatory review. It expects to clear GDA by 2026, which would mean the design is approved in principle. In parallel, Rolls is securing sites – it’s eyeing old nuclear sites like Trawsfynydd or Wylfa in the U.K. for the first units. It has also announced plans for a factory in Sheffield to manufacture reactor modules (pressure vessels, etc.), leveraging the U.K.’s steel industry. (world-nuclear-news.org).

The Rolls SMR is designed to have 90 % of its components made in factories, with only assembly on-site. (world-nuclear-news.org).

This modularization is key to cost reduction, though critics point out that until several are built, costs are still uncertain. Rolls estimates each 470 MW plant will cost around £2 billion once in serial production. One advantage Rolls touts is its extensive experience in nuclear manufacturing for sub reactors – giving it credibility in quality and safety. However, a full civilian power reactor has many differences (size, regulatory scrutiny, systems for generation etc.). Still, out of all the SMR startups, Rolls is unique in being part of a profitable, established engineering company. Rolls-Royce plc can, in theory, support the SMR unit through tough times, though the parent company has its own financial turnaround to manage post-2020. Market Performance: Rolls-Royce’s stock has been on a tear lately. Over the last year, RR. shares have more than doubled (up ~120 % YoY). (tradingeconomics.com).

thanks to a new CEO’s restructuring that revived the core aerospace business and improved earnings. In the past 6 months alone, the stock is up about 50 %. (tradingeconomics.com).

hitting levels not seen in years. Notably, in September 2025 Rolls-Royce stock reached around 1,190 pence – its highest in nearly a decade. (tradingview.com).

Part of this rally is due to strong jet engine orders and cash flow, but the SMR victory in the U.K. likely added some investor optimism as well. Analysts have raised targets; for instance, J.P. Morgan upgraded the stock after the SMR funding news, though they caution the stock is no longer cheap after the run-up. (fool.co.uk).

Current analyst consensus for Rolls in London is around £11.40 (~1140p), roughly where it trades now. (tipranks.com).

implying the upside is becoming more moderate. For U.S. investors, the ADR (RYCEY) has similarly surged (now around $16, with one analyst target at $19). (zacks.com).

Essentially, Rolls-Royce’s turnaround – and by extension its ability to invest in SMR – appears to be on track, but the easy gains might be past. Risks & Outlook: Rolls-Royce SMR benefits from major government backing and an existing industrial base, which reduce some financial risk. The U.K. funding means the first few units will be paid for, limiting risk of project failure due to lack of customers. However, challenges remain. Cost escalation is a concern: even £2.5 billion may not fully cover three FOAK units if they run over budget. Analyses suggest that for a 470 MW FOAK SMR, costs could easily exceed estimates – at a hypothetical $6,500/kW, four units would cost ~$12.2 billion, which is barely within the £10 billion per-winner budget the U.K. initially planned. Rolls will need to execute tightly to avoid overruns that could embarrass the government or cause cutbacks. Another risk is timing: The plan is to make a final investment decision by 2029 and have power on grid by mid-2030s. (world-nuclear-news.org).

Any political change or budget pressure in the interim could threaten that schedule (nuclear projects span multiple election cycles, and commitments can waver). There’s also competitive risk – e.g., if GE Hitachi’s smaller BWRX-300 (described below) succeeds sooner and cheaper, some export customers might favor that proven design over Rolls’ larger, unbuilt one. On the positive side, Rolls-Royce SMR is arguably the furthest along among SMR developers in securing actual orders. By winning the U.K. competition, it essentially has a pipeline of at least 3–5 reactors domestically, plus strong leads abroad. This means Rolls could be among the first to reach meaningful revenue from SMRs. As part of Rolls-Royce plc, the SMR venture could eventually be spun off or IPO’d once it has contracts in hand – potentially an opportunity for investors purely interested in the nuclear side. For now, investing in Rolls-Royce plc gives exposure not only to SMRs but also to a rebounding aviation business. Summing up, Rolls-Royce SMR has transitioned from a concept to a government-backed deployment program. Execution in the next few years (factory setup, licensing completion, site selection) will determine if it truly leads the pack or faces the delays that have beset many nuclear projects. Given the political will and funding now behind it, Rolls-Royce SMR stands a strong chance of delivering its first plant by early 2030s, making it a cornerstone of the U.K.’s net-zero strategy and a potentially lucrative export product.

GE Hitachi Nuclear Energy – Deploying the First Grid SMRs (via GE & Hitachi)

GE Hitachi (GEH) is a joint venture between General Electric (NYSE: GE) and Japan’s Hitachi, and it’s a quiet but major player in the SMR race. GEH’s design – the BWRX-300, a 300 MWe boiling water reactor – may well become the first operational SMR in the West. It’s based on decades-old boiling water reactor tech (essentially a downsized version of GE’s traditional reactors, with simplifications to reduce cost). By leveraging proven technology, GEH fast-tracked development and landed multiple customers. Key Projects & Timeline: The flagship project is in Canada. Ontario Power Generation (OPG) is constructing a BWRX-300 at its Darlington nuclear site near Toronto. This is slated to come online in 2028 – making it likely the earliest SMR deployment in North America. Site preparation and procurement are underway since 2022, and major contracts (for the reactor pressure vessel, etc.) have been signed. In fact, long lead components have been ordered. The Canadian regulator CNSC has been reviewing the design in parallel (through vendor design reviews) and gave OPG a site construction license in 2022, so things are moving. Next, Poland: A consortium led by ORLEN Synthos (a Polish chemicals and energy group) has committed to buy several BWRX-300 reactors. They target the first unit by 2029 in Poland, with potentially a fleet of 6–10 after that to replace coal plants. Poland’s government is backing this, and they’re in the licensing phase now. GE Hitachi also signed on to deploy a BWRX-300 in Sweden (with Kärnfull Next and others) and has interest in Estonia. In the U.S., GEH teamed up with the Tennessee Valley Authority (TVA) as well. TVA has an early site permit for an SMR at Clinch River, and while TVA is considering multiple designs, the BWRX-300 is a prime candidate given GEH’s progress. (Notably, in 2023 TVA actually chose GE Hitachi to potentially build a BWRX-300 at Clinch River in the 2030 timeframe, separate from the later-mentioned TVA/ENTRA1 6 GW NuScale plan – TVA is hedging bets by exploring both a large NuScale program and a nearer-term single GEH unit.) Funding & Structure: GE Hitachi Nuclear Energy itself is not a separate public company; it’s an alliance of GE and Hitachi. GE (through GE Vernova, its energy division) holds ~80 %, Hitachi ~20 %. GEH operates on a more traditional model of selling reactors and engineering services. For the OPG project, GEH is the vendor and will supply the reactor system, likely on a cost-reimbursable contract plus some fixed fees. GE has said the economics of BWRX-300 are promising – claiming it can be built for ~$2,000/kW if multiple units are ordered, which is far cheaper than typical new nuclear. That remains to be seen in practice. From an investor perspective, to get exposure to GEH one could invest in General Electric (NYSE: GE). GE is in the process of spinning off GE Vernova (power and renewables) in 2024–25. When Vernova is standalone, it will include GE’s nuclear ventures. However, GE is a huge company and SMRs are a small piece of it (the majority of value is gas turbines, wind turbines, and grid equipment). Hitachi is similarly large and diversified (and its stake in GEH is smaller). Status & Outlook: The BWRX-300 is arguably the closest to real revenue and operation. GEH already received partial payments on the OPG contract, and as construction progresses, GEH will be recognizing revenues for equipment manufacturing. By 2028 when the Canadian unit starts, GEH will have a reference plant to show the world. This “first mover” advantage is significant. The risk, of course, is ensuring the project stays on schedule and budget. If the Darlington SMR runs into problems (cost overruns, delays), it could tarnish GEH’s selling point of simplicity. But if it succeeds, it will validate the design and likely lead to more orders (Poland’s plans would accelerate, and other countries may sign up). Another point: GEH has lined up a supply chain (e.g., BWX Technologies in North America to fabricate reactor components, etc.) and leveraged its existing nuclear fuel business – BWRX-300 will use standard low-enriched uranium fuel, which is available from multiple vendors (no HALEU needed). This reduces fuel supply risk that plagues some competitors. GEH also secured financing agreements: e.g., the U.S. EXIM Bank approved up to $4 billion in financing for a Romanian SMR project (which uses NuScale), and one can expect similar support for GEH’s export projects. GEH vs Others: If NuScale and Rolls target utility-scale deployments, and Oklo/X-energy target niche/off-grid markets, GE Hitachi sits in a sweet spot addressing utilities that want a mid-sized, near-term reactor. Poland and Canada highlight this – both wanted proven tech ASAP. For ranking, GEH is at the top of “closest to revenue” list: its reactors are under construction and backed by well-capitalized customers (OPG is government-owned, Poland’s ORLEN is a large company). Profitability of these first projects might be low (FOAK learning costs), but once replication kicks in (Poland wants a fleet of 10 or more), GEH could see a steady stream of reactor sales by the 2030s. From an investment angle, though you can’t buy “GEH stock,” one might consider BWX Technologies (NYSE: BWXT), which will supply parts and fuel and already has a profitable nuclear business (including microreactors for NASA/DoD, and naval nuclear fuel). BWXT stands to gain from both GEH’s and TRISO-based SMR efforts. Similarly, Cameco (NYSE: CCJ), the uranium company, has exposure: it’s partnering with GE and Brookfield to acquire Westinghouse. While that’s large-reactor focused, Cameco also benefits from any new reactor (more uranium demand). In sum, GE Hitachi’s SMR program is a bit under the radar (since GE isn’t hyping it like a startup would), but it may quietly beat many newcomers to the finish line.

Kairos Power – Fluoride Salt Reactor Pioneer (Private)

Kairos Power is a U.S. startup working on a novel type of reactor: a fluoride salt-cooled high-temperature reactor (FHR). Founded by ex-University of California nuclear engineers and backed by investors like Bill Gates and Google, Kairos aims to create an efficient, load-following reactor that uses pebble fuel (TRISO pebbles) and molten fluoride salt coolant. Their design, KP-FHR (often just called “Kairos reactor”), is unique – it’s not a fast reactor like Oklo’s, and not a traditional water reactor like NuScale’s. It operates at high temperature (600°C) but low pressure, with inert salt carrying heat to a power conversion system. Timeline & Demo: Kairos is currently building a demonstration reactor named Hermes in Oak Ridge, Tennessee. Hermes is a scaled-down, non-power version (5 MWt) meant to test the technology. In an important milestone, Kairos received the first NRC construction permit for an advanced (non-LWR) reactor in Dec 2023. They wasted no time – by May 2025, Kairos poured the first nuclear safety-related concrete for Hermes. This marks the start of actual construction of the reactor’s foundation, the first such “new nuclear” build in the U.S. in decades outside of the big Vogtle project. Hermes is expected to go critical around 2026–2027, providing operational data on the FHR design. If all goes well, Kairos plans a scaled-up commercial reactor (~140 MWe) called KP-X in the early 2030s. Funding & Partnerships: Kairos has raised on the order of $600+ million from VCs and strategic partners. A big chunk came from a $303 million DOE award (Advanced Reactor Demonstration Program “Risk Reduction” grant). The grant essentially underwrites the cost of Hermes, which is enormously helpful. Private investors include Bill Gates (through Breakthrough Energy), Google, DARPA-related funds, and others. In fact, Google not only invested but is also a partner for eventual deployments – in October 2024 it was announced that Google and Kairos will collaborate on deploying Kairos reactors to power Google data centers, with an initial commitment to develop at least 820 MW of nuclear capacity. This partnership was highlighted alongside Amazon’s and is a big endorsement of Kairos’s tech for the AI/data center use-case. Additionally, Kairos works closely with Oak Ridge National Lab and Idaho National Lab on fuel and materials R&D. It is constructing many systems in a new facility in Albuquerque (its HQ). Kairos also formed a consortium with industrial firms for materials qualification (since molten salt at high temp is corrosive, they need special alloys). Kairos’s approach is incremental: build a small test reactor, then a bigger one. This lowers risk, but also means no significant revenue until the full commercial unit arrives. The company likely will need further funding rounds to finance the commercial prototype in the 2030s, unless a big partner (maybe a utility or tech company) comes in to co-fund. Outlook: Among advanced reactor startups, Kairos is notable for actually building hardware now. The Hermes demo construction progress is tangible – first nuclear concrete poured in 2025, reactor vessel delivered and being installed in 2025. This puts Kairos in a leadership position for demonstrating a Gen-IV concept on U.S. soil. If Hermes proves the system works (e.g., fuel handling, heat removal via salt, passive cooling, etc.), it will greatly de-risk the follow-on design. Commercially, Kairos is eyeing not only utility power but also industrial heat applications (since its outlet temperature ~600°C could support processes like hydrogen production or chemical manufacturing). Its partnership with Google suggests a focus on reliability and flexibility to meet data center loads (which require always-on power – something nuclear is good at – plus possibly the ability to adjust output, which the FHR can do via heat storage mediums). Risks: Kairos’s technology is arguably more complex than some rivals – molten salt coolant is a new frontier (though not as extreme as a molten salt reactor where fuel is dissolved, here fuel is solid and only coolant is salt). Materials and components (pumps, valves) must handle hot, radioactive salt over long periods; any unexpected corrosion could be an issue. The NRC license for Hermes was a big hurdle; licensing a full commercial FHR will be another, as it’s the first of its kind. Also, Kairos’s end-product (a ~140 MWe reactor) will compete in a crowded field by the 2030s – it’ll need to show economic advantages, like perhaps higher efficiency or a modular load-following ability, to win orders. Since Kairos is private, investors can’t directly participate now. But its progress should be noted as it might seek an IPO once Hermes data is in hand. The involvement of Gates and Google lends credibility and possibly patience (these backers are less likely to pull out quickly). If one is looking for potential future investment candidates in nuclear, Kairos could be one around 2026–2027, assuming Hermes is successful and they seek capital for the next phase. In summary, Kairos Power represents a medium-term bet: it won’t have a product on the market until the early 2030s, but it’s systematically retiring risks along the way. It’s a reminder that not all nuclear startups are just PowerPoints – some, like Kairos, have real reactors under construction right now, quietly making progress outside the spotlight.

Other Notables & International Players

Beyond the big names above, a few other companies are on the mini-reactor radar. Some are not investable or are early-stage, but they contribute to the overall landscape and hype:

Ultra Safe Nuclear Corp (USNC) / Standard Nuclear: USNC, a Seattle-based microreactor developer, was known for its 5 MWe Micro Modular Reactor (MMR) design using TRISO fuel. It had deals to deploy a demo at Chalk River in Canada and at the University of Illinois. However, USNC hit financial trouble and filed for Chapter 11 bankruptcy in late 2024. Its assets – including fuel tech and reactor IP – were acquired in 2025 by a new entity, Standard Nuclear, for a fire-sale ~$28 million. USNC’s collapse highlights the challenges of this industry: despite interest in its microreactor, it ran out of cash before revenue. An audit showed USNC had only €160 M cash in April 2025 vs. a €13 M/month burn rate, and would cease operations without new financing – which it couldn’t secure in time. Standard Nuclear (backed by NANO Nuclear Energy) is continuing some of USNC’s work, focusing initially on TRISO fuel supply and perhaps resurrecting the MMR later. For investors, this saga is a cautionary tale: even “Ultra Safe” bets can go bust in nuclear. It emphasizes doing due diligence on a startup’s financial runway and the importance of government support. USNC’s technology was solid and had customers, but it lacked sufficient bridge funding to commercialization. Now, those Canadian and Illinois projects are uncertain. The positive spin is that Standard Nuclear’s acquisition preserves the tech – they even raised $42 million to continue advanced fuel development. Still, anyone invested in USNC (privately) got wiped out.

Newcleo (France/U.K.): Newcleo is Europe’s biggest nuclear startup, working on lead-cooled fast reactors (LFR). Founded in 2021, it raised over €500 M and set up operations in the U.K., France, and Italy. Newcleo’s plan is to build a 30 MWe prototype LFR by 2031 and a 200 MWe commercial unit by 2035, and to fuel them with MOX fuel made from nuclear waste (plutonium). It’s an ambitious closed-fuel-cycle vision. However, Newcleo has encountered financing struggles recently. By mid-2025, it had burned through cash rapidly (1,000 employees, heavy R&D costs) and had not secured expected government co-investment. An audit warned of “significant risk” to Newcleo’s ability to continue if it fails to raise new funds within 12 months. As of Sep 2025, Newcleo has only ~1 year of cash left. Investors have been hesitant, waiting for the French or Italian governments to commit money (Newcleo’s strategy needs access to national plutonium stockpiles). The U.K. was initially its base, but the U.K. government decided not to utilize its plutonium for Newcleo’s fuel and has focused funding on Rolls-Royce’s SMR. Feeling unsupported, Newcleo announced in July 2025 it is suspending most U.K. activities and focusing on countries more open to Gen-IV reactors. It relocated HQ to France in 2024 and is seeking French and EU support to move forward. Newcleo did get some positive news: its 200 MWe design entered the U.K. regulator’s assessment in mid-2025, which is a first for an advanced reactor in Britain. But without funding, design reviews alone won’t save it. Newcleo has even cut ~150 jobs to conserve cash. Bottom line: Newcleo has promising technology and addresses the holy grail of waste reuse, but it illustrates that policy support is critical. Its home government (U.K.) essentially cold-shouldered it (not releasing U.K. plutonium for reuse, and prioritizing SMRs). Investors are waiting for France or Italy to step up with matching funds. If that happens, Newcleo could recover and be a European answer to TerraPower. If not, it may scale down dramatically. Since it’s private, the direct investment implications are limited now, but suppliers or partners could be affected. For instance, Newcleo had JVs in Slovakia for a MOX plant – those are on hold. Anyone betting on Newcleo should watch government decisions in the next 6–12 months. The company needs perhaps another €1 billion to get to prototype build – a big ask without state backing.

Westinghouse Electric – AP300 SMR: Westinghouse, a venerable name in nuclear, in 2023 unveiled the AP300, a 300 MWe SMR derived from its AP1000 large reactor. Westinghouse is currently privately held (Brookfield and Cameco ownership), but an IPO is expected in the future. The AP300 is pitched as using all proven components from AP1000, with hopes of deployment in the 2030s. It was a contender in the U.K. SMR competition but withdrew in 2024 due to not accepting the government’s funding terms. (neutronbytes.com).

Westinghouse is instead focusing on other markets, like Eastern Europe (it signed an MoU with Bulgaria, etc.). While not yet as advanced as Rolls or GEH in the SMR space, Westinghouse’s entry adds a serious competitor backed by a global service network. If and when Westinghouse IPOs, it will be a way to invest in both large reactor servicing and the new AP300 prospects.

Holtec International – SMR-160: Holtec (U.S. based, private) has a 160 MWe SMR design. It was also in the U.K. competition top 3. After losing out to Rolls, Holtec expressed disappointment but is continuing to seek other opportunities. (world-nuclear-news.org) (world-nuclear-news.org).

Holtec is notable because it’s already a major supplier of spent fuel storage systems – a profitable business it could use to cross-subsidize SMR development. It’s pursuing deployment in places like Ukraine and has applied for U.S. DOE loan guarantees. Holtec’s SMR is smaller and simpler (light-water design) but timeline is unclear. Not investable unless Holtec goes public.

Last Energy: Last Energy is a U.S. startup taking a very different approach – it offers a 20 MWe “micro” PWR that is packaged and can be prefabricated quickly. Last Energy focuses on Power Purchase Agreements (PPAs): it signs deals with customers to sell power at a set price, then builds the micro-plants to deliver it. They have announced multiple PPAs in Europe (UK, Poland, Romania) for dozens of units, each PPA typically ~50–100 MW in total. This has generated buzz because Last Energy sidesteps some of the political hurdles by going straight to private customers. However, the design is still in licensing phase (they plan to seek approval in the UK, for example). If those deals turn into actual projects in the late 2020s, Last Energy could become a significant private nuclear utility. For now, it’s venture-funded and high risk (a small team promising very cheap, quick nuclear – something yet to be proven). It’s not publicly investable, but it feeds the narrative of nuclear startups thinking creatively about business models (much like Oklo with selling power, not reactors).

Fusion Firms: While not fission SMRs, the overall “nuclear hype” in 2023–2025 has been amplified by breakthroughs in fusion startups (Commonwealth Fusion, Helion, etc.) and their massive funding rounds. Even tech companies like Microsoft have inked a purchase agreement with Helion for fusion power by 2028 (an ambitious, perhaps symbolic deal). The fusion excitement sometimes spills over into fission interest, as both are aimed at clean energy and often mentioned together by policymakers. However, fusion commercialization is farther out and not directly relevant to near-term SMR revenue – except that excessive hype for fusion could steal some thunder (and funding) from fission initiatives. For now, advanced fission like SMRs is much closer to market.

Ranking: Who’s Nearest to Revenue & Viability?

Taking stock of all these companies, none are yet generating significant reactor sales revenue – but some are very close, while others remain years away. Here’s a rough ranking of who is closest to having real commercial revenue streams and a working, profitable model versus who is furthest (along with key risks for each):

GE Hitachi (BWRX-300) – Closest to revenue. Why: It has actual reactor orders under execution (Canada, Poland) with deliveries by 2028. GEH will earn revenue through equipment supply long before then. It benefits from being part of GE (already profitable). Working model: Selling reactors and services to utilities – proven approach, just smaller size. Risks: Moderate – execution of first-of-kind in Canada (must meet cost/schedule), competition from other SMRs could emerge by the time it seeks more customers. But GEH likely becomes the first SMR vendor to generate substantial revenue, as early as 2025–27 from manufacturing contracts.

NuScale (SMR) – Next closest. Why: Although its first plant won’t run until 2029, NuScale is already earning small revenues from feasibility studies and pre-project work. It stands to sign its first firm reactor order by end of 2025 (management’s stated goal). With the big TVA/ENTRA1 deal, NuScale has a long-term pipeline that could translate into construction and equipment contracts later this decade. (prnewswire.com).

Risks: High – NuScale is still reliant on government support and its customers (UAMPS, Romania) haven’t fully committed to build yet. It’s burning cash and will likely need more financing. Delays could push out revenue. Also, NuScale’s model involves selling its reactor modules and engineering – if too few orders materialize, it won’t profit. However, given its advanced design approval and multiple MOUs, NuScale is arguably the first publicly traded SMR firm that could scale to profitability (perhaps by mid-2030s). Dilution risk is real: it had ~$1 M cash mid-2025, which may only last a couple of years of operating expense, so more equity raises (dilution) or debt are likely before breakeven.

Rolls-Royce SMR – Close in terms of guaranteed projects, but timeline longer. Why: Rolls has government-backed contracts essentially in hand – at least three units to be built in the U.K. starting around 2026–27 for delivery by early 2030s. (world-nuclear-news.org) (world-nuclear-news.org).

It will generate internal revenue by drawing on the £2.5B support for development and early construction. Being within Rolls-Royce plc, it doesn’t report separate financials, but one can consider the SMR unit as having a “funded mandate.” Risks: Execution and integration – it must deliver FOAK units close to budget to avoid political fallout. Also, Rolls plc will invest heavily up front (so far, it’s been all expense, no revenue for SMR unit). Profitability will depend on follow-on orders and how well they can bring down cost per unit. There is also political risk: a change in government or policy could in theory cut or delay funding (though U.K. consensus on nuclear is fairly strong currently). For investors in Rolls-Royce, the dilution risk is low (the SMR unit is funded by outside money, and Rolls plc is cashflow positive from other divisions). Instead, the risk is that SMR development costs could drag on Rolls’ earnings if not contained – but given the external funding, that’s mitigated. In sum, Rolls SMR will likely be a real business by the 2030s, with revenues from plant construction. It’s less risky financially than NuScale because of government support, but its later timeline means public market investors might not see the fruits until years from now (Rolls plc’s near-term performance hinges more on aero engines).

Oklo – High upside, high risk. Why: Oklo has no revenue yet (pre-revenue startup), but it does have an unusual asset: several power purchase agreements (Switch, USAF) that, if executed, become long-term revenue streams. (airandspaceforces.com).

Oklo’s plan to own and operate reactors means once its first unit runs (by ~2027–28), it will start selling electricity – recurring revenue akin to a utility. If it manages to deploy many reactors into the 2030s, it could have a stable cash-generating model (like an independent power producer). However, the road to get there is fraught. It must raise capital to build those reactors (the SPAC cash is not enough to build multiple units). That could mean project financing or issuing new equity – likely dilutive given the stock’s current high valuation might not sustain if timelines slip. There is also regulatory uncertainty; Oklo still lacks a license. Any denial or major delay by the NRC would derail its plans. Furthermore, Oklo’s valuation ($1 B+ at $110 share) already assumes success; any stumble could trigger a large correction (note the recent ~20 % dip on relatively small news). (coincentral.com).

From a profitability standpoint, Oklo won’t be positive EBITDA until it has a fleet of Auroras running – optimistic case, maybe early 2030s. In the interim, it’s reliant on investor funding. Dilution risk: Very high – Oklo will almost certainly need to issue shares or take on expensive funding to construct its first units (unless DOE loan programs help). On the flip side, if it meets its milestones, the stock could run further given the huge TAM (remote grids, data centers, etc.). It is the epitome of high-reward, high-risk in this sector.

X-energy – Moderate risk, steady progress. Why: X-energy, while private, has a fairly clear pipeline (Dow project, ARDP demo, possibly Amazon-backed projects). These will yield revenue through project milestones, likely starting with DOE payments and engineering contracts in the next few years. By ~2027, if the Dow reactor construction starts, X-energy will generate substantial revenue from that build. It has a services+tech licensing model: they’ll supply reactors, fuel (via TRISO-X), and perhaps operate them with partners. Risks: Funding and execution. The collapse of the SPAC means X-energy needs to close a funding gap – it reportedly required ~$1 B from the SPAC to fully fund its projects. Without that, it must raise in private markets or a new IPO, which could be challenging (risk of delayed projects if funding is slow). However, the involvement of Dow and Amazon provides some confidence – those giants wouldn’t commit if they thought X-energy would evaporate. They might even help finance the projects or invest directly in X-energy if needed. Technical risk for X-energy’s reactor is moderate (HTGRs have been built before, albeit smaller ones; fuel is in-hand since TRISO-X is being built to produce it). Licensing risk exists but the NRC seems supportive (fast-tracking review). Dilution risk: For future public investors, potentially moderate – by the time X-energy goes public, it might be at a lower valuation than the original SPAC deal, which could dilute early investors. But new investors at IPO would presumably get in at that reset valuation. Overall, X-energy appears to have a path to become a revenue-generating company by late this decade (with Dow’s reactor and DOE demo), with the possibility of profitability if it can replicate sales to other industrials. The Amazon partnership hints at a long runway of projects (5 GW by 2039 is huge), but execution will tell.

TerraPower – Well-funded, long-term. Why: TerraPower will not have any power plant revenue until at least 2030 when Natrium starts up (even then, that’s a demo). It’s essentially a R&D venture funded by billionaires and government. However, it’s less risky financially because Gates and others provide patient capital, and the DOE is sharing costs. (powermag.com).

TerraPower doesn’t face dilution in the public sense, since it’s private, but one could consider it “diluting” early investors with each funding round (though Gates likely doesn’t mind). The risks are mainly technical/regulatory (will Natrium work as planned? can they get fuel?) and geopolitical (reliance on Russian HALEU was a lesson; they are now pushing for domestic supply). The company is diversified (also doing isotope production which could bring some revenue earlier). Profitability is distant – likely dependent on selling multiple Natrium plants post-2030, or perhaps licensing the tech abroad (they have a partnership in China for traveling-wave reactor earlier, but that halted due to US-China tensions). TerraPower’s model might end up being like SpaceX’s Starship – a game-changer funded by a billionaire until it’s fully developed, then it undercuts competitors on performance. Not an investable entity now, but extremely influential. Risk to sector: if TerraPower’s high-profile demo fails or is delayed heavily, it could tarnish advanced nuclear in eyes of public. Conversely, its success would boost everyone.

Holtec, Newcleo, others – Farthest from revenue. Why: Holtec’s SMR-160 hasn’t secured a first build yet (though they aim for one at Oyster Creek in New Jersey eventually). It’s still in design/licensing phase and will need either government support or international orders to break ground. Holtec does have profitable businesses (spent fuel storage) to sustain it, so it’s not in danger, but its SMR timeline is uncertain – maybe late 2030s. Newcleo is in serious financial peril; without a big new funding round, its plans might not materialize at all. It’s spending a lot with no revenue and got caught in a place with insufficient government support. If it does get funded and builds the 30 MW demo by 2031, that’s the earliest revenue (and even that demo might not be profit-generating, more a proof-of-concept). Newcleo’s risk of dilution or failure is high – existing investors could be heavily diluted if new capital comes in at a down valuation, or the company could shrink operations to survive. Ultra Safe Nuclear (USNC) already went bankrupt – the ultimate revenue failure. Standard Nuclear might salvage something, but it’s essentially a reset. This shows that many of the smaller microreactor concepts may not reach market without continuous infusions of capital or government rescue.

Dilution and Capital Risk Summary: For the publicly traded ones (or soon-to-be): NuScale (SMR): Has raised cash but likely needs more before breakeven (expected in 2030s). It may issue new equity if stock remains reasonably high. There’s also a possibility of strategic investment (e.g., Fluor or another industry player injecting cash). The stock’s big run-up allowed it to consider raising capital at better prices – indeed NuScale filed a shelf registration in 2023 for potential stock sales. Investors should expect dilution unless major revenue (orders) comes very soon. Oklo (OKLO): Almost certain to dilute given the ambitious expansion plans. With a current $1 B valuation, one could argue they should issue stock sooner rather than later to raise a war chest (even a 5 % dilution at these levels could fund a lot). Insiders already took some money off the table. (coincentral.com).

which might hint at eventual equity offerings. If the stock stays high, Oklo might follow the playbook of EV startups: sell more shares to fund capex. If the stock drops significantly, it complicates financing. In any case, external capital will be needed to build 1 reactor (~$1 M for a 15 MWe Aurora per Oklo’s estimate) let alone dozens. Watch for any DOE loan applications from Oklo – that could be non-dilutive funding to build plants if approved. Rolls-Royce: Unlikely to dilute for SMR – its parent’s improved cash flow plus government money cover most needs. Rolls may even seek external investors at the SMR subsidiary level (there was talk of selling a stake to raise funds, before the government stepped in). If anything, Rolls might spin off SMR unit via IPO in late 2020s once it has projects underway, which could unlock value for shareholders rather than dilute them (since it’d be a separate listing of an asset the market isn’t fully valuing inside Rolls). X-energy: When it goes public, presumably it will raise funds – possibly at a lower valuation than initially planned, which effectively dilutes earlier expectations but new public investors would just buy at whatever that price is. The key is whether it can secure enough funding to build Dow’s plant; Dow might finance a lot, so X-energy could manage with less dilution than a company that has to fund reactors itself. If Amazon/Constellation put equity in, that could also reduce need for public dilution. Regulatory and Execution Risks: Across the board, a common risk is regulatory delays. NRC processes, while improving, are non-trivial. A design certification can take 3–4 years; a construction permit maybe 2 years; an operating license another 1–2. These timelines can slip if new issues are discovered. Companies like Oklo and Kairos that are doing first-of-kind designs face steeper learning curves with regulators. Policy changes (like the U.S. pushing NRC to speed up, as was ordered in 2025) are helping, but it’s still a process. Execution is another big one – building nuclear plants on budget has historically been hard (see: Vogtle’s delays and overruns). The hope is that SMRs, being smaller and modular, avoid that. But until a few are built, it’s an open question. Investors should be prepared for potential news of schedule slips or cost revisions – which could jolt stock prices (especially NuScale and Oklo which trade heavily on future prospects).

Conclusion: Hype vs. Reality in the Nuclear Renaissance

In the past six months, the mini-reactor sector has seen soaring stock prices, bold government bets, and growing mainstream recognition. The narrative that “nuclear is back” – driven by energy security needs, climate goals, and the insatiable power demands of AI – has real substance. We have, for the first time in decades, multiple reactor projects under construction or about to start (Canada’s SMR, TerraPower’s site work, Kairos’s demo, etc.). Major corporations outside the traditional utility sphere (Amazon, Dow, Google, Microsoft) are endorsing nuclear as key to their operations. This is a sea change that has rightly fueled investor optimism. However, investors must disentangle hype from reality. The excitement has in some cases run well ahead of what companies have actually achieved. For instance, Oklo’s $10+ billion valuation reflects enormous future success that is anything but certain – it is a bet on a concept and a charismatic backer. Likewise, NuScale’s big rally shows how momentum can build quickly around the only public pure-play SMR, but one should recall it’s still pre-profit and has many hurdles before earning that valuation. Analysts covering these stocks urge caution. Goldman Sachs’s neutral take on Oklo cited the need for “de-risking” – i.e., Oklo must secure real customer contracts (beyond MOUs) and prove its tech before its valuation is justified. For NuScale, analysts have largely moved to Hold, noting the stock’s price now factors in much of the foreseeable good news. (marketbeat.com).

Essentially, the upside from here relies on flawless execution and maybe additional big deals (e.g. another country signing up, or a U.S. federal buy program). Any stumble (a delay in the UAMPS project, a cost increase, etc.) could trigger a correction. On the other hand, one can argue there remains significant upside potential sector-wide if milestones are hit. For example, when TVA’s 6 GW SMR program was announced, NuScale’s stock jumped ~25 % in a day, demonstrating how hungry the market is for validation of these companies’ prospects. If Oklo were to receive an NRC license acceptance or announce its first reactor fabrication started, its stock could surge further on the narrative becoming real. Price targets in the sector often look at multi-year horizons: e.g., some NuScale bulls have targets $50–60 (while it’s ~$38 now). (marketbeat.com).

assuming it converts its pipeline to orders. For Rolls-Royce, many analysts are optimistic long-term (the average 2029 share price forecast is ~1618p vs ~1160p now). (tradingeconomics.com) (tipranks.com).

implying that as SMR and other projects progress Rolls’ stock should appreciate. But those are 4–5 year views; near-term, most see these stocks as fairly valued after recent runs. In ranking profitability, none of these ventures will have a “working, profitable model” until at least late this decade. The first to actually turn a profit might be GE Hitachi’s SMR business (within GE) if they deliver multiple units by 2030. NuScale might achieve profitability in the 2030s if it secures a fleet order (the 6 GW TVA program, if fully realized, could certainly put NuScale in the black once operational, but that builds out through the 2030s). Oklo and X-energy likely won’t be EBITDA-positive until they have several reactors generating cash – perhaps mid-2030s. So investors in 2025 are playing the long game here. Regulatory and Policy Shifts: It’s important to acknowledge that the policy environment is the best it’s been in decades for nuclear. The U.S.’s Inflation Reduction Act provides production tax credits for new nuclear, making the economics more attractive. The DOE is pouring money into multiple designs simultaneously. Even a potential change in U.S. administration in 2025 (as hinted by references to a Trump order) appears to keep support for nuclear – in fact, possibly accelerate it through deregulatory moves. In Europe, high energy prices and the gas crisis have opened minds to SMRs (France, U.K., Poland, Czech all moving forward). That said, nuclear projects still must navigate local opposition, stringent safety culture, and supply chain challenges – none of which can be solved simply by throwing money or political will at them. Finally, the “AI hype” component: It’s true that AI data centers are extremely power-hungry and companies want 24/7 clean energy. Nuclear can provide that, and deals like Switch-Oklo, Google-Kairos, Amazon-X-energy underscore the synergy. But one should keep in mind these are long-term plans. Amazon’s 5 GW by 2039, Switch’s 12 GW by 2044 – these are decadal commitments. They do not guarantee near-term revenue for the reactor companies; rather, they are signals of intent. The “AI needs nuclear” narrative is compelling, but it will take years for it to translate into reactor deployments. Meanwhile, these nuclear startups must survive and execute. In conclusion, the mini-reactor sector sits at an inflection point: real construction has begun in some places, yet the hardest work lies ahead in scaling from first units to profitable fleets. Investors have bid up the pioneers (NuScale, Oklo) on future promises, and those stocks will likely remain highly volatile – sensitive to every licensing update, contract win, or technical milestone achieved (or missed). Prudent investing here means watching the 6-12 month catalysts: Does NuScale sign a binding order with UAMPS or Romania? Does Oklo get an NRC docketing or a DOE loan guarantee? Does Rolls-Royce sign a contract and break ground on its first unit? Does GE Hitachi hit its schedule in Canada? These will separate the likely winners from the also-rans. The nuclear renaissance is real, but it won’t be uniform. Some companies will almost certainly fall short or dilute shareholders heavily, while others that execute could become the next energy giants. A brutal reality is that building reactors is complex – delays or cost overruns can quickly turn a rosy projection into a financial quagmire (as seen historically). But unlike the past, these SMR developers have more technology options and lessons learned, plus a supportive policy framework. As one industry observer put it, “Resurgence is in the air, but 2025 will be about turning resurgence into contracts”. Investors should remain brutally realistic: demand is growing and the addressable market is enormous, but not every startup will survive to meet it. Picking the likely winners requires evaluating their technical maturity, funding strength, and partnerships. Based on recent data, GE Hitachi, NuScale, and Rolls-Royce SMR appear relatively well positioned with strong backing and near-term projects. Oklo and X-energy offer higher risk/reward – big upside if they deliver, but significant risk of value dilution if they stumble or need heaps of new capital. TerraPower is a long-term dark horse backed by deep pockets – less a commercial bet at this point, more of a strategic one for the 2030s. And cautionary tales like USNC’s bankruptcy or Newcleo’s funding woes remind us that even in a hype cycle, cash flow is king; you can’t run on ideas alone. As the next six months unfold, expect more volatility. Positive catalysts (e.g., an SMR startup hitting a milestone early) could send stocks soaring further, while negative news (e.g., a regulatory setback or a dilutive capital raise) could trigger sharp sell-offs. This sector is not for the faint of heart – but for those with a long vision and the ability to tolerate swings, it may transform the energy landscape and reward the winners handsomely. For now, cautious optimism with an eye on each company’s execution and cash burn is warranted. The mini-nuclear gold rush has begun; which companies strike gold will become clearer with each passing quarter of progress (or lack thereof).

Read the full research paper: https://chatgpt.com/s/dr_68dcf14419c4819199764af2beca8cd3

Sources:

Investor analysis of NuScale’s recent momentum and risks; Trefis, Sept 25, 2025. NuScale Q2 2025 results, noting revenue jump to $1 M and cash ~$1 M. Trefis on NuScale’s NRC approval of 77 MWe design and historic TVA 6 GW SMR agreement. TVA press release on 6 GW program (ENTRA1 partnership) emphasizing data center demand driving it. (prnewswire.com) (prnewswire.com).

Bloomberg Law report on Oklo’s SPAC debut: stock fell to $8.45 with $1 M raised. CoinCentral analysis of Oklo’s stock in 2025: +420 % YTD, +1188 % YoY, then insider selling & Goldman neutral rating ($117) causing pullback. CoinCentral on Oklo: insiders sold significant shares (CEO ~$1 M as a gift; others ~$6–9M) and Goldman’s caution about unproven tech and high valuation. (coincentral.com).

World Nuclear News on Oklo’s Aurora design and timelines: first commercial unit aimed by end of decade (late 2027–28). WNN on Oklo’s huge 12 GW deal with Switch data centers (Master Agreement for 12 GW by 2044). WNN on Oklo’s model (build-own-operate, sell power not plants) and Aurora specs now up to 50 MWe per unit. Reuters on U.S. advanced reactor fuel supply issues: TerraPower’s Natrium delayed ~2 years to 2030 due to lack of HALEU after Russia ban. (powermag.com).

Power Magazine confirming TerraPower’s 2-year delay to 2030 launch for Natrium demo (original 2028) due to fuel supply challenges. (powermag.com) (powermag.com).

WNN on Rolls-Royce SMR winning U.K. competition (June 2025): government to sign contracts and allocate site, connect by mid-2030s. (world-nuclear-news.org) (world-nuclear-news.org).

WNN image caption of Rolls-Royce SMR plant rendering. (world-nuclear-news.org).

Neutron Bytes update that U.K. awarded £2.5B for Rolls SMR and £14.2B for Sizewell C in June 2025. Neutron Bytes analysis of SMR costs: a single Rolls 470 MW FOAK could cost ~$1 B, four units ~$1 B, which is borderline within £10B budget for 4 – highlighting FOAK cost risk. Trading data showing Rolls-Royce share price up ~120 % year-on-year and ~50 % in 6 months. (tradingeconomics.com).

hitting all-time high ~1191 GBX in Sep 2025. (tradingview.com).

ANS Nuclear Newswire on Ultra Safe Nuclear’s bankruptcy: filed Chapter 11 in Oct 2024 to sell to Standard Nuclear. Nuclear-news.net summary of Newcleo’s audit: significant going-concern risk if no new funding in 12 months; losses €103M in 2024, €13M/month burn, €160M cash in April 2025. World Nuclear News on Newcleo scaling back U.K.: lack of U.K. govt support for Gen-IV, U.K. plutonium not available for fuel, refocusing on other countries. ANS Newswire on Amazon and Google deals (Oct 2024): Amazon with X-energy 5 GW by 2039; Google with Kairos to add 820 MW for data centers. Reuters piece on surging nuclear interest as AI drives power demand: “U.S. nuclear development activity has soared as surging power demand from AI accelerates the need for low-carbon power”. Trefis/Forbes on analyst sentiment: NuScale stock now largely a Hold with average ~$37 target (stock ~$38). (marketbeat.com).

Oklo initiated at Neutral by GS citing stretched valuation. Yahoo/TipRanks: Rolls-Royce analyst average target ~1173p vs 1163p current, high 1440p. (tipranks.com).

(implying modest expected upside near-term).

Citations

TVA and ENTRA1 Energy Announce Collaborative Agreement in Landmark 6-Gigawatt NuScale SMR Deployment Program - Largest in U.S. History

NuScale Stock: Big Gains, Bigger Risks | Trefis

https://www.trefis.com/stock/smr/articles/575874/nuscale-stock-big-gains-bigger-risks/2025-09-25

TVA and ENTRA1 Energy Announce Collaborative Agreement in Landmark 6-Gigawatt NuScale SMR Deployment Program - Largest in U.S. History

NuScale Power (SMR) Stock Forecast and Price Target 2025

https://www.marketbeat.com/stocks/NYSE/SMR/forecast/

It's not a tiny home. It's actually a nuclear microreactor powerplant

https://newatlas.com/energy/oklo-aurora-nuclear-microreactor-idaho/

It's not a tiny home. It's actually a nuclear microreactor powerplant