Hydrogen Energy: Storage for Renewable Energy

See full essay: https://chatgpt.com/s/dr_6928f48ae8e8819183e8ea9b511bd876

Hydrogen Energy: Powering a Global Green Revolution

Figure: A fuel-cell vehicle (Toyota Mirai) refueling at a California hydrogen station, while an Air Products “SmartFuel” hydrogen delivery truck supplies the fuel. Hydrogen enables zero-emission transport with fast refueling similar to conventional fuels.

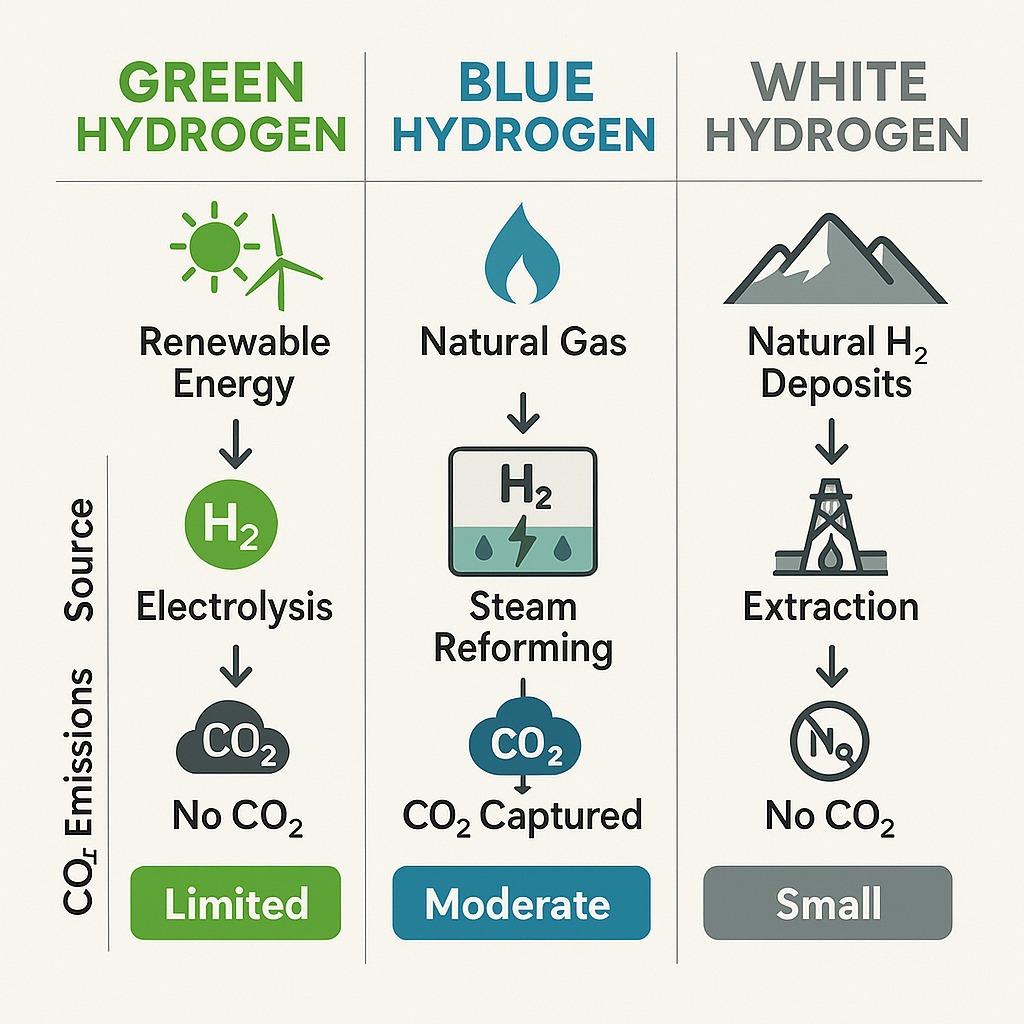

From Grey to Green – The Spectrum of Hydrogen Types

Hydrogen comes in many colors (figuratively) depending on how it’s produced. Traditionally most hydrogen has been grey, made from natural gas without capturing emissions, but newer low-carbon types are rising . The key varieties are:

Green hydrogen: Produced by splitting water (electrolysis) using renewable electricity (solar , wind, etc.), yielding hydrogen and oxygen with zero CO2 emissions. Green hydrogen is currently a small share of supply (it’s still costly), but like solar and wind power , its cost is expected to fall sharply with scale.

Blue hydrogen: Made from fossil fuels (usually natural gas) via steam methane reforming, paired with carbon capture to trap the CO2 byproduct. Blue hydrogen is considered “low- carbon” – it still generates CO2 during production, but captures most of it for storage instead of releasing it. It’s a bridge solution leveraging existing natural gas resources while cutting most emissions.

White hydrogen: Refers to naturally occurring hydrogen found in underground geological formations. This hydrogen is generated by natural geochemical reactions and exists in certain rock reservoirs. It requires no energy-intensive production – it “comes ready-made” – which means if tapped, it could be extremely cheap (potentially under $1 per kg). However, white hydrogen is a nascent field: only experimental projects (e.g. a pilot well in Mali powering a village) exist so far, and most potential reserves remain unexplored.

Each type has a different carbon footprint and production method, but all hydrogen fuel is emission-free at point of use. Whether burned or used in a fuel cell, hydrogen recombines with oxygen to produce only water vapor. This makes hydrogen an attractive clean energy carrier – especially when produced in a low-carbon way (green, blue, or possibly white) instead of the traditional high-emission methods.

Safety Matters: Hydrogen’s Safety Profile

As a fuel, hydrogen must be handled with care – but its risks are well-understood and manageable with proper engineering. In fact, hydrogen has some safety advantages over conventional fuels. For example, hydrogen gas is non-toxic (unlike gasoline fumes) and, being the lightest element, it disperses upwards and dilutes quickly if leaked. This rapid dispersion means that in open air a hydrogen leak is less likely to pool and cause a fire at ground level, compared to heavier gasoline or propane vapors.

That said, hydrogen is highly flammable over a wide range of concentrations in air and has an ignition energy much lower than gasoline. In practical terms, even a small spark can ignite a hydrogen-air mixture if it accumulates. For this reason, hydrogen systems require vigilant leak detection, ventilation, and ignition source control. Because hydrogen flames burn nearly invisible, special flame sensors are used in hydrogen facilities. Materials selection is also crucial: hydrogen can embrittle metals like steel, so tanks and pipelines use alloys or liners that resist cracking.

The good news is that industry has decades of experience handling hydrogen (used extensively in refineries and chemical plants). Modern hydrogen fuel tanks (for cars or storage) are robust carbon-fiber composites tested to resist bullets and crashes, and fueling stations are equipped with automatic shut-offs and sensors. In fact, studies and real-world testing show hydrogen can be as safe as gasoline or natural gas when proper protocols are followed. With rigorous standards (many countries have updated hydrogen safety codes) and training, the hydrogen industry is building a solid safety record. As hydrogen use expands, this focus on safety will continue to build public confidence.

Driving the Future: Hydrogen in Transport

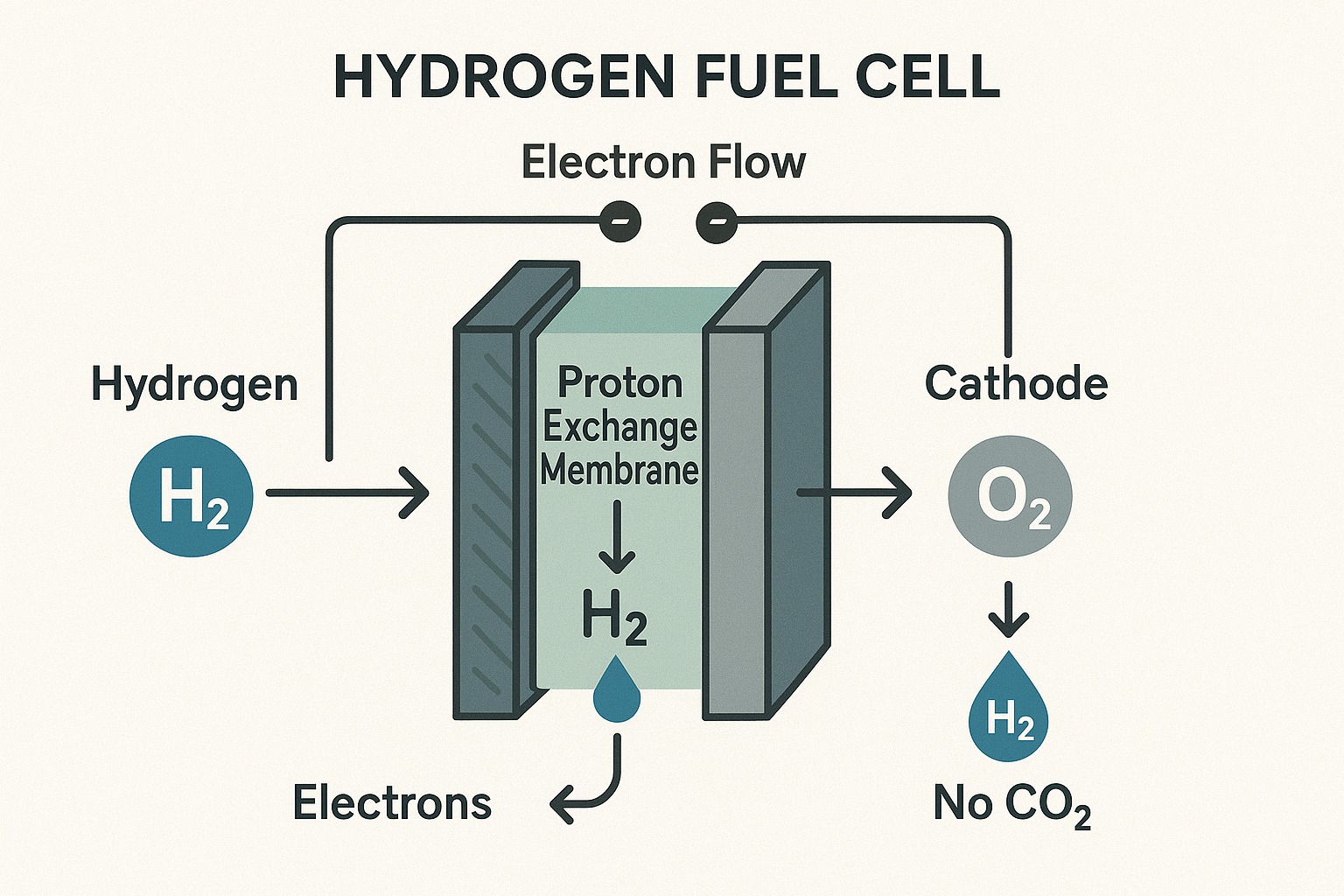

Hydrogen is hitting the road – and the rails, seas, and skies. In the transport sector, fuel cell electric vehicles (FCEVs) are a key application. These vehicles use hydrogen gas to generate electricity in a fuel cell, emitting only water. Major automakers have developed fuel cell cars (Toyota Mirai, Hyundai Nexo, Honda Clarity) and buses. Over 90,000 FCEVs have been sold globally as of 2024, and hydrogen fueling infrastructure is growing. Asia-Pacific leads in adoption: Japan, South Korea, and China have rolled out thousands of FCEVs and built hundreds of hydrogen fueling stations, spearheading this market. For example, Japan’s government supports a hydrogen fuel cell fleet as part of its clean transport strategy, and South Korea’s plans aim for 6.2 million hydrogen vehicles on its roads by 2040. Europe and North America are also deploying hydrogen buses and trucks in pilot projects (California and Germany, for instance, operate hydrogen buses for public transit).

Why hydrogen for transport? Refueling a hydrogen vehicle takes just 3–5 minutes (similar to gasoline), giving it an edge over battery EVs in uptime. Hydrogen also packs a lot of energy without a heavy battery, which is crucial for heavy-duty vehicles. This makes fuel cells attractive for long-haul trucks, buses, trains, and even ships. Companies like Hyundai and Toyota are putting fuel-cell trucks into service, and hydrogen-fueled trains have debuted in Germany (replacing diesel on non-electrified rail lines). In aviation, hydrogen is being explored both as a fuel for combustion and via fuel cells for small aircraft – Airbus has announced plans for a hydrogen-powered airplane by 2035. The common theme is that hydrogen could decarbonize transport modes where batteries are too heavy or charging is too slow. With only water coming out of the tailpipe, hydrogen vehicles eliminate CO2 and pollutants, offering clean air benefits especially in cities. As production of green hydrogen scales up (bringing costs down), we can expect hydrogen mobility to surge, complementing battery EVs in a future mix of clean transport options.

Fueling Industry: Hydrogen’s Role in Industrial Decarbonization

Perhaps the most transformative impact of hydrogen will be in heavy industries – the factories that produce our steel, cement, chemicals, and fertilizers. These sectors are notoriously hard to decarbonize, because they often require high heat or use fossil fuels as feedstock. Hydrogen offers a path to deeply cut emissions in these processes, and momentum is building globally to make it happen.

One of the flagship examples is steelmaking. Traditional steel plants use coal in blast furnaces to remove oxygen from iron ore, a process emitting huge CO2 volumes (steel accounts for ~8% of global emissions). Hydrogen can replace coal as the reducing agent. In 2021, a Swedish venture called HYBRIT made the world’s first steel produced without coal, using green hydrogen instead – and delivered it to Volvo as a trial batch. This fossil-free steel production method emits only water, and scale-up plans are underway for full commercial production by 2026. Similarly, companies in Germany, North America, and China are retrofitting or designing direct-reduction iron (DRI) plants to run on hydrogen, aiming to produce “green steel” at scale. Governments are supporting these efforts as part of industrial decarbonization strategies (for example, the EU’s plans for net-zero by 2050 rely on hydrogen to clean up steel, cement, and chemical plants).

The chemical industry is another arena. Hydrogen is a core feedstock for making ammonia (used in fertilizer) and refining oil. Today, ammonia production and oil refining use mostly grey hydrogen (from natural gas) and together emit significant CO2. Transitioning to green hydrogen for ammonia can cut those emissions to zero – effectively creating green fertilizers. Several fertilizer companies (e.g. Yara in Norway, CF Industries in the US) are investing in electrolyzers to produce green hydrogen for ammonia. Likewise, refineries are looking at blue or green hydrogen to replace their current hydrogen (used for desulfurizing fuels) to reduce the refinery’s carbon footprint.

Hydrogen can also provide the high-temperature heat needed in industries like cement, glass, and petrochemicals, where electric heating is challenging. Burning hydrogen in industrial furnaces produces a flame as hot as natural gas combustion but without carbon emissions. Pilot projects in the UK and EU have tested hydrogen firing in cement kilns and glass factories successfully. More broadly, experts see hydrogen as critical for cutting emissions in heavy industry – IEA’s Executive Director Fatih Birol noted that low-carbon hydrogen could play a “critical role in reducing emissions from industrial sectors such as steel, refining and chemicals”. As carbon prices and clean-energy policies kick in, industries are increasingly signing on to hydrogen offtake agreements to secure future supply. In short, hydrogen is set to fuel the next industrial revolution – a green one, enabling heavy industry to maintain production while aligning with climate goals.

Powering the Grid: Hydrogen for Energy Storage and Electricity

Hydrogen’s versatility extends to the power sector as well. It can be used to generate electricity in turbines or fuel cells, offering a carbon-free substitute for natural gas or coal. One promising role is as a long-term energy storage medium to balance renewable energy. Excess solar and wind power can be used to produce hydrogen (via electrolysis) when supply exceeds demand; that hydrogen can then be stored and later converted back to electricity during periods of low renewable output (e.g. nights or winter months). This essentially turns hydrogen into a “renewable battery” for the grid, but one that can store massive amounts of energy for long durations.

For example, in Utah (USA), a project is underway to store green hydrogen in underground salt caverns, each capable of holding 150,000 MWh of energy – the equivalent of 80,000 lithium battery packs worth of storage in a single cavern. That hydrogen will feed the Intermountain Power Project, whose gas turbines are engineered to gradually shift from natural gas to 100% hydrogen by 2045. At startup in 2025 the plant will burn a 30% hydrogen mix, cutting CO2 emissions by ~75%, and ultimately it will run entirely on hydrogen for truly carbon-free, dispatchable power. This will be one of the world’s first large-scale “green hydrogen” power plants, demonstrating how stored renewable energy (in the form of hydrogen) can be deployed on demand to stabilize the grid.

Globally, major turbine manufacturers like GE, Siemens, and Mitsubishi are racing to hydrogen-enable power generation. New gas turbines are being built “hydrogen-ready,” capable of burning hydrogen blends today and shifting to 100% hydrogen fuel in the future. In Europe, the HYFLEXPOWER project in France has already demonstrated a turbine running on 100% green hydrogen at an industrial combined-heat-and-power plant. Meanwhile, stationary fuel cell systems are providing emission-free electricity for data centers and buildings – Microsoft, for instance, tested hydrogen fuel cells to replace diesel backup generators at its server facilities. South Korea has even deployed thousands of small and large fuel cells feeding into the grid as part of a national initiative, and aims for 15 GW of fuel cell power capacity by 2040 to supply clean electricity and heat.

Hydrogen in the power sector is essentially an enabler of high renewable penetration: it can soak up surplus green power, store it seasonally, and reconvert it when needed. It also offers a way to decarbonize existing gas-fired power plants and provide carbon-free peaking power or grid balancing. Though the round-trip efficiency (electricity → hydrogen → electricity) is lower than batteries, the quantity of energy that can be stored as hydrogen is vast and cost-effective for long durations, something batteries can’t economically achieve. This makes hydrogen a key piece in the puzzle of a 100% clean energy grid.

Investment Boom and Market Trends

Money is pouring into hydrogen. What was once a niche of R&D has, in just the past few years, become a major investment frontier in the clean energy transition. As of 2025, over $110 billion in investments have been committed to more than 500 low-carbon hydrogen projects worldwide (either under construction or at final investment decision) – a $35 billion jump in one year. This explosive growth has averaged about 50% year-over-year since 2020, indicating the rapid maturation of the hydrogen industry. More than 1,700 projects have been announced globally, from small electrolyzer installations to massive hydrogen production hubs, and even with some attrition, the project pipeline could deliver up to 9–14 million tonnes of clean hydrogen capacity by 2030. Investors and companies are clearly betting big on hydrogen’s future.

Market forecasts reflect this optimism. Estimates for the global hydrogen market value by 2030 range in the hundreds of billions of dollars, as hydrogen expands from its current industrial uses into energy, transport, and heating. The Hydrogen Council, a global CEO-led industry coalition, has grown from 13 founding companies in 2017 to 140+ multinational companies in 2023 – all aligning on a “united vision” for scaling up hydrogen solutions. These include energy giants (Shell, BP, TotalEnergies), industrial gas leaders (Linde, Air Liquide), automakers (Toyota, Hyundai), and many others across the hydrogen value chain. Their combined market cap and resources underscore that hydrogen is now mainstream in corporate decarbonization strategies.

For instance, oil major Shell has announced it will spend up to $1 billion per year on hydrogen and related carbon-capture projects in 2024 and 2025, and is building Europe’s largest electrolyzer (100 MW) in Germany to produce green hydrogen. Industrial gas firm Linde is investing heavily in hydrogen production and infrastructure, such as partnering with Shell on the German project. Auto companies like Toyota and Hyundai continue to pump R&D into fuel cell vehicles and even hydrogen combustion engines for trucks. In the U.S., startup Nikola is developing hydrogen semi-trucks and building out fueling networks (despite some setbacks, highlighting the challenges of new tech). Meanwhile, fuel cell manufacturers (e.g. Ballard, Plug Power) and electrolyzer makers (e.g. Nel ASA, ITM Power) have scaled up factories, anticipating surging demand for equipment.

On the financial side, governments and venture capital are providing strong backing. Dozens of hydrogen-focused startups have attracted funding for innovations in electrolysis, storage, and fuel cells. Stock markets have seen hydrogen company IPOs and rising valuations (albeit with volatility). A telling indicator of market sentiment: the share of global hydrogen projects that have moved to concrete implementation (construction or firm financing) has doubled in the last year. However, analysts note a remaining gap – while production capacity is accelerating, demand creation needs to catch up. Many projects hinge on future customers in transport or industry committing to buy hydrogen, and on policies that make clean hydrogen cost-competitive. This is where government policy (like carbon pricing, subsidies, or mandates) becomes crucial to ensure the burgeoning supply finds a market. Overall, the trajectory is clear: barring unforeseen obstacles, the 2020s are set to be the decade of hydrogen scale-up, with exponential growth in production and a rapidly expanding ecosystem of producers, distributors, and users.

Global Momentum: Policies and Initiatives Worldwide

Hydrogen has become a global endeavor, with major economies in a sort of friendly race to lead the hydrogen economy. Policymakers across Europe, North America, and the Asia-Pacific have launched ambitious plans to support hydrogen deployment, each tailored to their regional context but sharing the goal of harnessing hydrogen for energy security and climate targets. Here’s a look at initiatives across these key regions:

The European Union sees hydrogen as vital for its Green Deal and climate neutrality by 2050. The EU’s 2020 Hydrogen Strategy and 2022 REPowerEU plan set bold targets – aiming for 10 million tonnes of domestic renewable hydrogen production and 10 million tonnes of imports by 2030. This 20 Mt goal is extremely ambitious (for scale, that’s nearly a quarter of current global hydrogen demand), and reflects Europe’s urgency to replace natural gas (especially after the Russia supply crisis) and decarbonize industry. To reach it, Europe has created a Clean Hydrogen Alliance to coordinate projects, funded multi-billion-Euro “Important Projects of Common European Interest (IPCEI)” for hydrogen infrastructure, and is developing a “hydrogen bank” mechanism to subsidize green hydrogen uptake.

The United States has dramatically accelerated hydrogen development in the last couple of years thanks to landmark legislation. In 2021, the Bipartisan Infrastructure Law earmarked $8 billion for creating Regional Clean Hydrogen Hubs across the country. In late 2023, the Biden Administration announced funding for seven hydrogen hubs spanning 16 states – from California and Texas to the Midwest and Appalachia – with $7 billion in federal support to leverage $40+ billion in private investment. These hubs aim to produce over 3 million tonnes of clean hydrogen per year collectively, about one-third of the U.S. 2030 production goal. Roughly two-thirds of the hydrogen in these hubs is planned to be green (electrolysis using renewables/nuclear) and one-third blue (natural gas with CCS), reflecting an “all of the above” approach to jumpstart volume.

Japan has been championing hydrogen for decades – it was the first to roll out a national hydrogen plan and fuel cell vehicles. In 2023, Japan updated its Basic Hydrogen Strategy, setting a goal to use 3 million tonnes of hydrogen and ammonia by 2030 and a staggering 12 million tonnes by 2040. To achieve this, Japan is mobilizing massive investment: about 15 trillion yen (~$110 billion) in public-private funding over 15 years.

South Korea likewise sees hydrogen as a pillar of its economic future. The government’s Hydrogen Economy Roadmap targets domestic hydrogen demand of ~1.9 million tonnes by 2030 and 5+ million tonnes by 2040.

China is a hydrogen behemoth in the making. While it doesn’t yet have a single unified national hydrogen strategy, it has strong policy signals embedded in its 14th Five-Year Plan and various provincial plans.

Environmental and Economic Advantages

Hydrogen’s appeal lies in its potential to deliver deep environmental benefits while also spurring economic growth. On the environmental side, the advantage is straightforward: when used as a fuel, hydrogen produces no greenhouse gases or air pollutants – only water. Every kilogram of hydrogen that replaces a fossil fuel (gasoline in a car, coal in a furnace, natural gas in a turbine) prevents significant CO2 emissions.

Economically, the hydrogen sector promises new industries and jobs, technological leadership, and energy security benefits. Investment in hydrogen infrastructure and projects creates jobs in engineering, construction, manufacturing, and operations – often in industrial regions needing sustainable growth.

Conclusion: The Hydrogen Horizon

Hydrogen energy is no longer a distant dream or a buzzword – it’s becoming a tangible reality across the globe, driving a new era of clean innovation. From the fueling stations of California and Tokyo to the steel mills of Sweden and the vast solar farms of Australia, hydrogen is steadily weaving into the fabric of our energy and industrial systems.

Hydrogen energy offers a path to fuel the world without burning the planet. By explaining its types, demystifying safety, showcasing its wide applications, and highlighting the massive investments and policies backing it, we see a compelling picture of an energy revolution underway.

See full essay: https://chatgpt.com/s/dr_6928f48ae8e8819183e8ea9b511bd876

Sources

- https://commons.wikimedia.org/wiki/File:Hydrogen_fueling.jpg

- The hydrogen colour spectrum | National Grid

- White hydrogen: 5 of the most critical questions answered | World Economic Forum

- Safe Use of Hydrogen | Department of Energy

- [PDF] Hydrogen-Insights-2024.pdf

- Fuel Cell Vehicle Market Set for Explosive Growth - AltEnergyMag

- South Korea’s Hydrogen Strategy and Industrial Perspectives | Ifri

- Sweden's HYBRIT delivers world's first fossil-free steel | Reuters

- Low-emissions hydrogen projects grow as policy support races to catch up | IEA

- Mitsubishi Power delivers Hydrogen-Ready Gas Turbines to “IPP Renewed” Project in Utah | Mitsubishi Power Americas

- Siemens Energy Joins Forces for Bold 100% Hydrogen HL Gas Turbine Leap | POWER Magazine

- First successful demonstration with 100% green H2 | Hyflexpower

- HYFLEXPOWER project demonstrates 100% hydrogen operation | Gas Turbine World

- Global hydrogen industry surpasses USD 110 billion in committed investment as 500+ projects worldwide reach maturity | Hydrogen Council

- About the Council | Hydrogen Council

- Shell will spend up to $1bn annually on hydrogen and CCS in 2024 and 2025 | Hydrogen Insight

- Linde to Build 100 MW Green Hydrogen Plant for Shell REFHYNE II | Linde Engineering

- REPowerEU | European Hydrogen Observatory

- From Strategy to Reality: The EU's Global Role in the Hydrogen Economy | European Relations

- Europe is struggling to get its green hydrogen sector moving

- Biden-Harris Administration Announces Regional Clean Hydrogen Hubs to Drive Clean Manufacturing and Jobs | The White House (archive)

- Hydrogen is developing fast in Japan, closer to societal use | World Economic Forum

- Japan aims to boost hydrogen supply to 12 million T by 2040 | Reuters

- Republic of Korea (South Korea) – HyResource | CSIRO

Share This Post

💬 Join the Discussion

Have thoughts on this article? Share them below! Sign in with your GitHub account to leave a comment.

More Posts

View All Posts

AI Acceleration, the "Power Race," and Near-Term Societal Shock Risk Through 2035 (Part 1: Short-Term Vision)

The full unabridged deep research report - Part 1, Short-Term Vision: AI acceleration, the power race, and societal shoc...

Mini Nuclear Reactors (SMRs): Deep Dive into Key Players, Tech & Market Trends

Small modular reactors (SMRs) and microreactors – essentially “mini” nuclear power plants – are gaining momentum as a ca...

Had You Heard of Notion? Have You Used It? It is the early shape of the cognitive work

Discover the true power of Notion as an all-in-one collaborative workspace platform. Learn how it revolutionizes knowled...

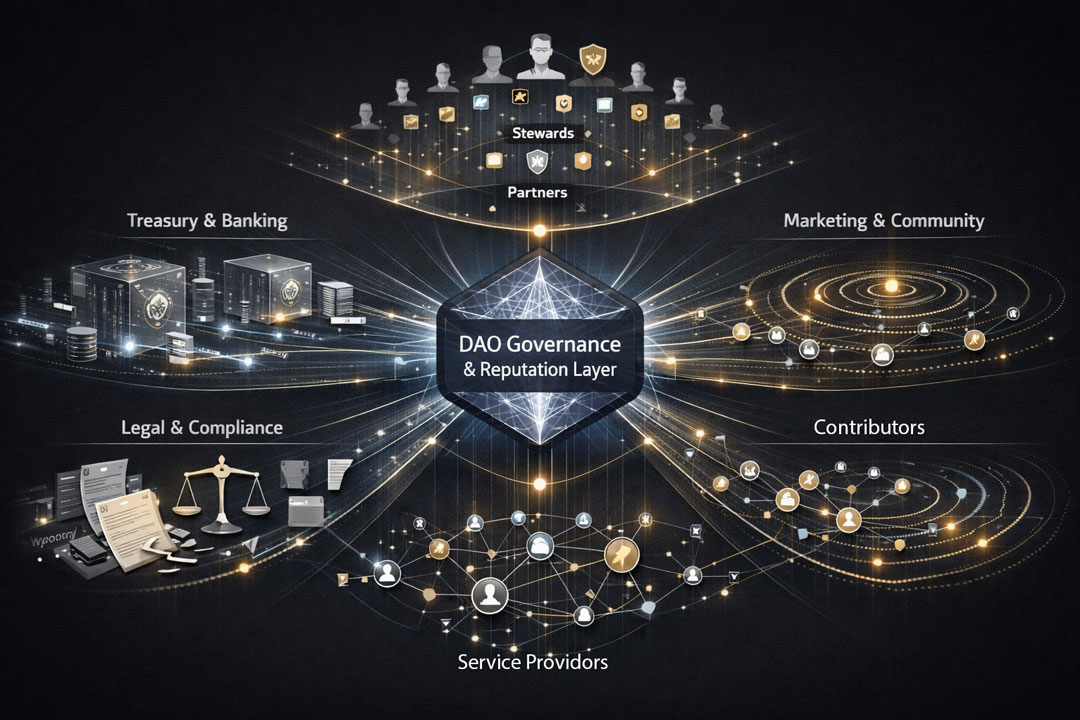

The Future of Work is Here: DAO-Firms and the Automation of Trust

Explore how DAO-Firms will reshape traditional companies in the future of work. Learn about the automation of trust and ...

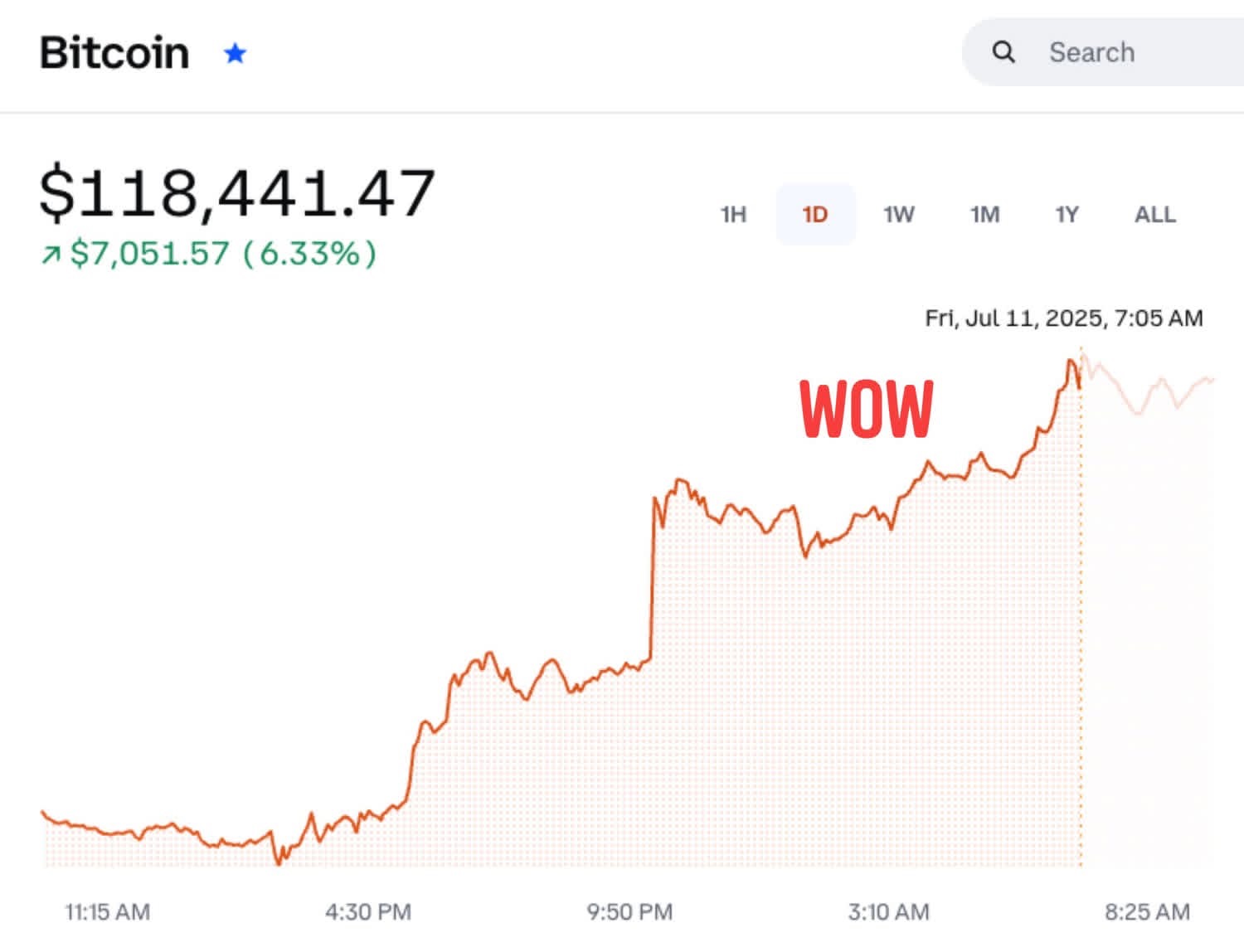

Bitcoin’s 24‑Hour Price Explosion: Decoding the Breakout and the Road Ahead

Discover the reasons behind Bitcoin's 24-hour price explosion to a new all-time high of $118,500. Explore the market ana...

Bitcoin to $700K: The Path to an Unprecedented Financial Milestone

Explore the potential of Bitcoin to reach $700K and its impact on the financial world. Learn about key factors driving B...