Bitcoin’s 24‑Hour Price Explosion: Decoding the Breakout and the Road Ahead

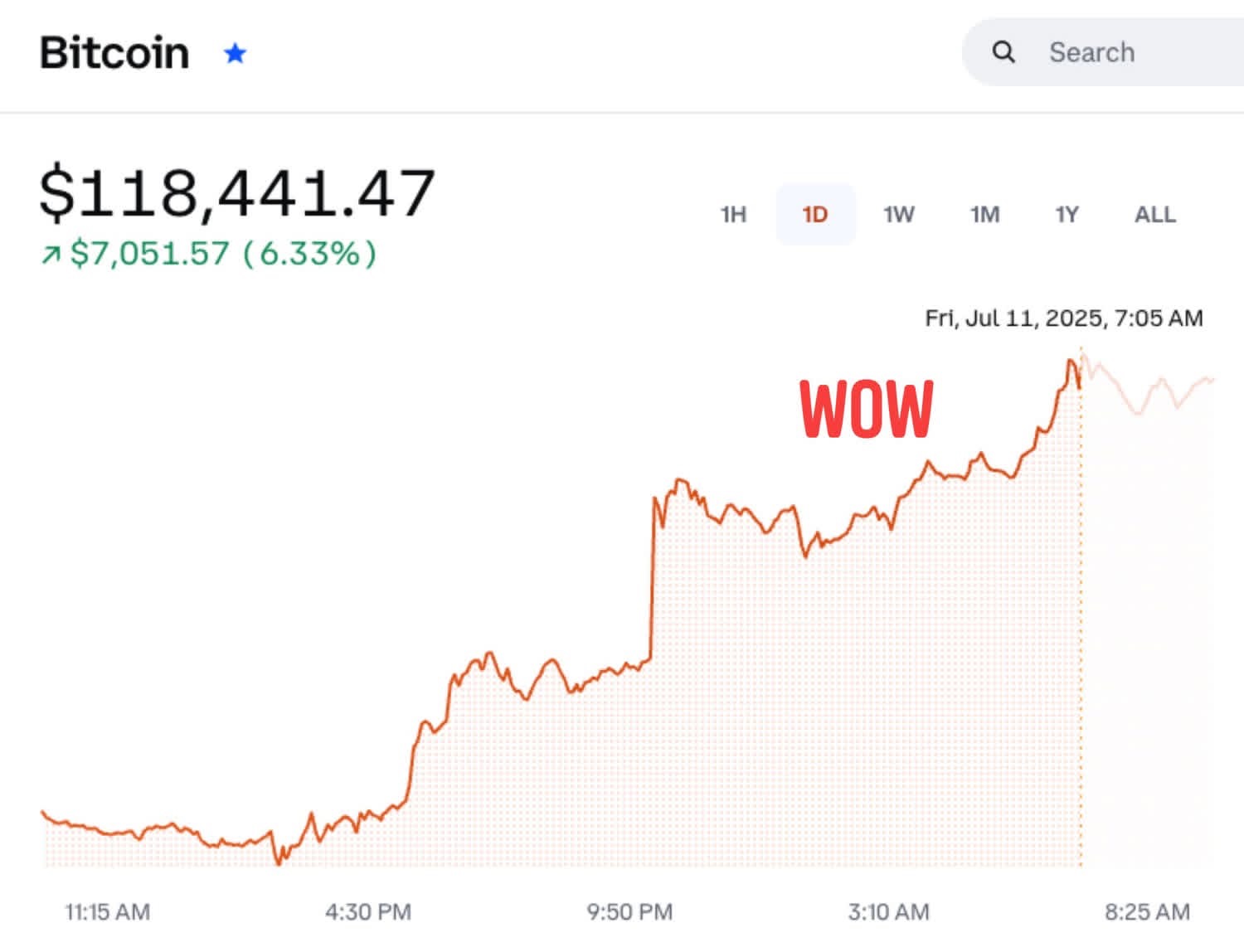

Bitcoin and the broader crypto market just rocketed upward in one of the sharpest 24-hour rallies in recent memory. In the span of a day, Bitcoin surged to a new all-time high (peaking around $118,500) and dragged the entire market higher with it. This aggressive market analysis dissects why this breakout happened, examines key technical metrics (RSI, funding rates, open interest, etc.), and explores the broader implications. We’ll also sound the alarm on a looming long-term risk – the quantum computing threat to Bitcoin’s encryption – before making the case for a bold stance: buy Bitcoin, short fiat (especially the USD). Strap in – the financial system’s plates are shifting, and fortune favors the bold.

What Fueled Bitcoin’s Sudden Breakout?

Institutional FOMO Meets Macro Weakness: The latest rally was ignited by a confluence of powerful forces. On the institutional front, massive inflows into Bitcoin ETFs signaled big money rushing in. In fact, U.S. spot Bitcoin ETFs saw a sudden $407.8 million surge of inflows as Bitcoin pushed past $110K. Year-to-date, these funds have added tens of billions; as of July 9 they managed $136.5 B in BTC (up from $105.4 B at the year’s start) – a testament to wall-of-money demand from traditional finance. This flood of capital from the likes of BlackRock and Fidelity is fuel for the fire, validating Bitcoin’s mainstream appeal and depriving skeptics of their last refuge.

Meanwhile, macro winds turned in Bitcoin’s favor. The U.S. dollar – Bitcoin’s foil – has been sagging. A depressed Dollar Index (DXY) put the greenback on the back foot, boosting risk assets like Bitcoin. With the dollar weakening and real yields near turning points, the opportunity cost of holding “hard” assets dwindles. Macroeconomic cracks are showing – from rising recession risks to ballooning debt – spurring anticipation of central bank easing. In this environment, Bitcoin’s appeal as digital gold and monetary alternative shines bright. Even political tailwinds played a role; high-profile endorsements (e.g. bullish remarks by a U.S. President) bolstered the pro-crypto narrative and added momentum. In short, institutional flows and macro weakness created a powder keg – and a spark was all that was needed.

Technical Breakout Triggers: That spark came in the form of technical catalysts that set traders ablaze. Bitcoin’s price had been coiling in a bullish flag pattern, and when it finally ripped above the consolidation, it confirmed a textbook bull flag breakout with a measured upside target near $120,000. Momentum indicators were already flashing green – the 50-day moving average crossed above the 200-day (a “golden cross”), and trading volumes expanded on the breakout. Once Bitcoin decisively punched through its previous record high (~$112K), it unleashed pent-up buying. Automated buys and trend-following algos piled on, sensing the regime change. At the same time, many altcoins (from Ether to obscure memecoins) saw 20%+ intraday gains alongside BTC, underscoring a broad risk-on frenzy in crypto. In essence, a perfect storm of bullish fundamentals and technical triggers set the stage for Bitcoin’s explosive 24-hour move.

Short Squeeze and Technical Drivers Amplify the Rally

Figure: Crypto market daily liquidation volumes show a massive spike in short position liquidations (red bars) as Bitcoin’s price broke out. Over $1 billion in short bets were wiped out within 24 hours, with Bitcoin alone accounting for about $590 million of those liquidations. This cascade of short covering added explosive fuel to Bitcoin’s rally, forcing bears to buy back into a climbing market and accelerating the uptrend.

The rally’s ferocity was magnified by a classic short squeeze. In the days leading up to the breakout, bearish traders had been increasingly confident – and that proved to be their undoing. Data tells the tale: open interest in Bitcoin futures jumped from ~$32 B to $35 B as the price approached $110K, while the long/short ratio plunged (from 1.22 to 0.86) as short positions piled in. In other words, many traders bet heavily on a drop, “creating the potential for a significant short squeeze if BTC broke its record high” around $112K. Once that level was cleared, it triggered stop-losses and liquidations en masse. Within one day, over 232,000 traders saw their short positions obliterated in a >$1 Billion liquidation bloodbath – one of the largest wipeouts in recent memory. As each short got forced to cover (buy BTC), it propelled the price higher, feeding a self-reinforcing rally. Crypto analysts described the scene bluntly: “Bears in disbelief” and a “MASSIVE short squeeze” gripping the market.

Below are some key metrics that underscored the breakout’s momentum and the market’s state during this surge:

- Relative Strength Index (RSI): Bitcoin’s daily RSI surged to ~71 during the breakout, reflecting strong (if near overbought) momentum. This marked a decisive shift into bullish territory – an RSI above 70 often signals overbought conditions, but in this case it underscored the extraordinary force of buying pressure propelling BTC upward.

- Funding Rates: Perpetual futures funding rates flipped firmly positive, indicating that long traders were so aggressive they paid a premium to shorts for holding positions. This positive funding signaled bullish conviction, as traders were effectively saying “take my money, I want to stay long.” Elevated funding is a warning that longs are crowded, but in this case it showed just how one-sided the momentum had become in favor of bulls.

- Open Interest (OI): Futures open interest spiked alongside price, climbing from about $32B to $35B during the run-up. Rising OI indicated new capital rushing in. Crucially, much of this OI increase was attributable to new shorts (as evidenced by the falling long/short ratio), which built the powder keg for the subsequent short squeeze. When the squeeze hit, that high OI started to unwind violently, squeezing out the late short sellers.

- Liquidations: As noted, a short liquidation cascade ensued. In the 24-hour span of the breakout, over $1.0 B in crypto short positions were liquidated, including roughly $570 M in BTC shorts (versus only ~$20 M in longs). Data from Coinglass shows ~$448M of shorts blown out on Wednesday and another ~$283M on Thursday, illustrating how the squeeze played out over consecutive days. This forced unwinding of shorts not only added buying pressure, it also served as a brutal lesson in the risks of betting against an uptrending Bitcoin.

All told, the technical backdrop turned overwhelmingly bullish. Market structure flipped: bears went from pressing their advantage to running for the hills. The result was a virtuous cycle for bulls – higher prices begot more liquidations, which begot higher prices. By the end of the day, Bitcoin had blasted through resistance and is now within sight of the next psychological milestone (~$120K). The breakout validated the bullish technical signals and punished complacent shorts in spectacular fashion.

Quantum Computing: The Next Great Threat to Bitcoin’s Security

Amid the euphoria, it’s critical not to lose sight of long-term challenges. One looming threat on the horizon is quantum computing – and its potential to break Bitcoin’s classical encryption. Bitcoin’s security relies on tried-and-true cryptography: the ECDSA elliptic curve (secp256k1) for signatures and SHA-256 for hashing. These schemes are rock-solid against today’s computers. But the coming era of quantum computers could change the game: sufficiently advanced quantum machines running Shor’s algorithm would be able to crack ECDSA private keys from public keys, or significantly weaken SHA-256 collisions.

How soon could this happen? Experts fiercely debate the timeline. Recent advances suggest the danger might arrive sooner than we hoped. Google researcher Craig Gidney hinted that prior estimates were too pessimistic – quantum resources needed to break RSA (a similar encryption) were overestimated, and that Bitcoin’s ECC could be vulnerable by ~2030–2035. In fact, government standards bodies are already sounding alarms: NIST plans to retire 256-bit ECC by 2030 and outright ban it by 2035 in favor of quantum-safe alternatives. This implies that within the next 5–10 years, Bitcoin’s current cryptography might no longer be considered secure.

Some industry veterans remain skeptical – for instance, cryptographer Adam Back believes practical quantum attacks on Bitcoin are at least a couple decades away, though even he concedes that users would eventually need to migrate coins to quantum-resistant addresses (including, hypothetically, Satoshi’s ancient stash). But others issue far more urgent warnings. Security CEO David Carvalho claims Bitcoin could be cracked within five years, noting that novel tech (like Microsoft’s quantum-inspired Majorana chips) could accelerate the timeline. He estimates nearly 30% of BTC resides in addresses that are “quantum-vulnerable” (e.g. reused addresses with exposed public keys). Even BlackRock – now a major Bitcoin ETF player – has acknowledged the quantum risk in its filings, a sign that institutions are taking this seriously. Chamath Palihapitiya, a billionaire investor, warned in late 2024 that if companies like Google scale their 100+ qubit processors, SHA-256 could be broken in as little as 2–5 years, urging the crypto industry to “update encryption protocols before it’s too late.”

The Bitcoin network must evolve to defang this quantum threat – and the clock is ticking. Luckily, the community is not standing idle. Researchers and developers are exploring post-quantum signature schemes (lattice-based cryptography, hash-based signatures, etc.) that could replace or augment ECDSA. The likely response will be a hard fork or soft fork in the coming years to implement quantum-resistant algorithms, well before quantum computers are powerful enough to pose a real danger. We have a window of perhaps a decade or less to execute this transition. That means by the early 2030s, Bitcoin should upgrade its cryptographic armor – turning the looming “quantum apocalypse” into just another Y2K-style nonevent. The takeaway for investors today: enjoy the bull run, but demand ongoing innovation from the ecosystem. Bitcoin has proven adaptable through past upgrades (SegWit, Taproot); quantum defense will be the next big test to ensure BTC remains the “hardest money” in the world, uncrackable and unshakeable.

Bold Stance: Buy Bitcoin, Short the Dollar

The evidence is overwhelming – a financial inflection point is here. Bitcoin’s lightning surge, backed by tangible flows and data, is a clarion call to investors: it’s time to be bold. The pieces of the puzzle all point the same way:

Institutional Alignment: The smart money is positioning for a crypto future. Wall Street titans and public companies are loading up on Bitcoin – U.S. ETFs and corporations added hundreds of thousands of BTC to their holdings this year. When the biggest asset managers on the planet are pouring capital into Bitcoin, they’re effectively shorting the old order. We now see even sovereign wealth funds and nation-states accumulating BTC. This isn’t retail speculation; it’s a structural reallocation of capital. Follow the money: it’s flowing out of fiat and into crypto.

Macro Weakness & Fiat Fragility: The USD and other fiat currencies are on borrowed time. Decades of money printing and unsustainable debt have set the stage for fiat depreciation. The recent dip in DXY (dollar index) is not a blip – it’s a trend. As inflation remains sticky and growth falters, central banks will be forced back into dovish policy, undermining their currencies. The U.S. dollar’s purchasing power (and by extension, all fiat) is eroding, and no amount of political theater can change the math. Shorting fiat – especially the dollar – is essentially shorting ever-deepening debt and deficits. Bitcoin, with its provable scarcity and disinflationary supply, is the antidote to this fiat fiasco.

Market Technicals & Momentum: The technical breakout we just witnessed is a loud affirmation of Bitcoin’s strength. New all-time highs on high volume, a rising RSI, and a confirmed bullish pattern breakout – these are not signals to fade; they’re signals to ride. Every major indicator, from moving averages to on-chain metrics, suggests that the path of least resistance is up. And the sheer scale of the short squeeze – over $1B of liquidations – shows that plenty of skeptics have been blown out. The wall of worry is being climbed relentlessly. The smart play is to be on the long side of this momentum (long BTC), not fighting it.

Systemic Shift in Play: This is not a mere speculative spike; it’s part of a systemic shift. We are watching in real time as a new monetary regime is born. Bitcoin’s censorship-resistant, mathematically secured network offers a stark alternative to the aging fiat system of politicized central banking. The narrative is flipping: where once Bitcoin was called “magic internet money,” it’s now seen as digital gold 2.0, a treasury reserve asset for the 21st century. The entire $3.6 trillion crypto market cap is a rounding error in global finance – there is tremendous room to run as this paradigm shift accelerates. The decision by investors is binary: align with the future (crypto) or cling to the past (fiat). The conviction trade is clear.

Buy Bitcoin. Short the dollar. This isn’t just a catchphrase – it’s a strategy grounded in the realities of the recent market moves and the macro trajectory. Going long BTC while shorting USD (or USD-priced assets) is essentially a bet on continued crypto strength and fiat debasement. Could there be volatility and pullbacks? Absolutely – Bitcoin’s path is never a straight line. But dips are opportunities; the trend is your friend. With each passing day, Bitcoin further ingrains itself into the global financial system, while the dollar-based order edges closer to its denouement.

Conclusion: A Financial Revolution Unfolding

The past 24 hours provided a stark illustration of Bitcoin’s power and the changing tides of finance. A surge driven by institutional conviction, technical might, and a short-selling massacre has announced Bitcoin’s arrival into six-figure price territory. But beyond the price, take note of the larger narrative: the old guard financial system is being upended by a decentralized upstart born just over a decade ago. We are witnessing a transfer of trust and value on a historic scale – from the centralized walls of fiat finance to the open, algorithmic, and borderless realm of crypto.

Investors would be wise to act accordingly. The recommendation here is unapologetically aggressive because the situation warrants it. Bitcoin is not just another asset; it’s a revolt against the depreciating dollar and a bet on a new economic order. The breakout and metrics we’ve dissected show a market that is screaming confidence. Yes, keep an eye on long-term challenges like quantum computing – the community must stay vigilant and innovative. But these are hurdles that can and will be overcome. The immediate reality is that Bitcoin’s ascent is accelerating, and the support pillars (institutional adoption, public sentiment, macro necessity) are stronger than ever.

In life, there are rare moments when conviction and opportunity intersect – this is one of them. The crypto faithful have long proclaimed “buy the dip,” but now even the dips are higher highs. It’s time to buy the rip and double down on the future. Go long on Bitcoin, short the frailties of fiat, and embrace the systemic shift underway. The market has given its verdict over the last 24 hours: the revolution will not be televised by the old media – it will be digitally distributed on the blockchain. Don’t blink, don’t hedge, and don’t be left on the sidelines. The next chapter of finance is being written now, and it favors the bold.

Sources: The analysis above is backed by real data and reports from industry sources, including liquidation and funding data from CoinGlass, institutional flow figures from ETF providers, on-chain and market insights from Glassnode, and expert commentary on Bitcoin’s technical breakout and macro drivers. Additionally, warnings on the quantum computing threat are drawn from crypto security experts and recent research, highlighting the 2030–2035 window for quantum risk and the urgency for Bitcoin to adapt. All told, the convergence of these factors paints a compelling picture: Bitcoin’s 24-hour surge is not an anomaly but a sign of things to come. Let the skeptics laugh now – history shows they won’t be laughing for long.

Share This Post

💬 Join the Discussion

Have thoughts on this article? Share them below! Sign in with your GitHub account to leave a comment.

More Posts

View All Posts

Had You Heard of Notion? Have You Used It? It is the early shape of the cognitive work

Discover the true power of Notion as an all-in-one collaborative workspace platform. Learn how it revolutionizes knowled...

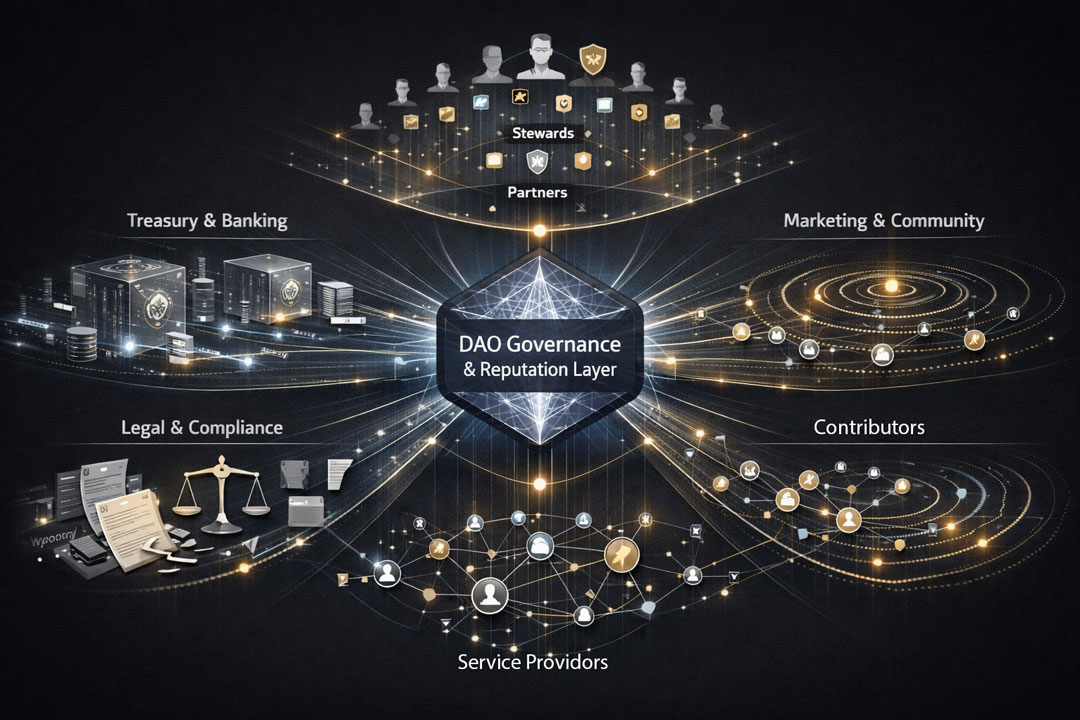

The Future of Work is Here: DAO-Firms and the Automation of Trust

Explore how DAO-Firms will reshape traditional companies in the future of work. Learn about the automation of trust and ...

Mini Nuclear Reactors (SMRs): Deep Dive into Key Players, Tech & Market Trends

Small modular reactors (SMRs) and microreactors – essentially “mini” nuclear power plants – are gaining momentum as a ca...

Bitcoin to $700K: The Path to an Unprecedented Financial Milestone

Explore the potential of Bitcoin to reach $700K and its impact on the financial world. Learn about key factors driving B...

AI Acceleration, the "Power Race," and Near-Term Societal Shock Risk Through 2035 (Part 1: Short-Term Vision)

The full unabridged deep research report - Part 1, Short-Term Vision: AI acceleration, the power race, and societal shoc...

Hydrogen Energy: Storage for Renewable Energy

Discover the different types of hydrogen energy - green, blue, and white - and how they are powering the global green re...