Bitcoin to $700K: The Path to an Unprecedented Financial Milestone

𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐭𝐨 $𝟕𝟎𝟎𝐊: 𝐓𝐡𝐞 𝐏𝐚𝐭𝐡 𝐭𝐨 𝐚𝐧 𝐔𝐧𝐩𝐫𝐞𝐜𝐞𝐝𝐞𝐧𝐭𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐌𝐢𝐥𝐞𝐬𝐭𝐨𝐧𝐞

Bitcoin, the revolutionary digital currency, has already proven its potential as a disruptive force in the financial world. As we look to the future, many experts and enthusiasts believe that Bitcoin can reach the extraordinary value of $700,000 per coin within the next decade.

This blog will explore the key factors that could drive Bitcoin to this unprecedented milestone and what it means for investors and the global economy.

𝐂𝐮𝐫𝐫𝐞𝐧𝐭 𝐏𝐫𝐢𝐜𝐞 𝐨𝐟 𝐁𝐢𝐭𝐜𝐨𝐢𝐧

As of today, Bitcoin is trading at approximately $64K per coin. This price reflects its significant growth over the past decade, but the journey to $700K will require overcoming several milestones and capitalizing on various trends.

𝟏. 𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐈𝐧𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧𝐚𝐥 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧

One of the most significant factors driving Bitcoin's potential rise to $700k is the increasing adoption by institutional investors. Major financial institutions, including hedge funds, asset managers, and public companies, are incorporating Bitcoin into their portfolios.

This institutional interest not only adds legitimacy to Bitcoin but also brings substantial capital into the market.

𝐊𝐞𝐲 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬:

- MicroStrategy and Tesla: High-profile companies like MicroStrategy and Tesla have made significant investments in Bitcoin, signaling confidence in its long-term value.

- Bitcoin ETFs: The approval and launch of Bitcoin Exchange-Traded Funds (ETFs) have made it easier for traditional investors to gain exposure to Bitcoin, further boosting demand.

𝟐. 𝐋𝐢𝐦𝐢𝐭𝐞𝐝 𝐒𝐮𝐩𝐩𝐥𝐲 𝐚𝐧𝐝 𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝

Bitcoin's unique supply dynamics are central to its value proposition. With a maximum supply capped at 21 million coins, Bitcoin is inherently deflationary. As demand continues to rise, the limited supply can lead to substantial price appreciation.

𝐅𝐚𝐜𝐭𝐨𝐫𝐬 𝐃𝐫𝐢𝐯𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝:

- Store of Value: Bitcoin is increasingly seen as digital gold, a hedge against inflation and economic instability.

- Global Acceptance: More businesses and merchants are accepting Bitcoin as a means of payment, enhancing its utility and demand.

𝟑. 𝐓𝐞𝐜𝐡𝐧𝐨𝐥𝐨𝐠𝐢𝐜𝐚𝐥 𝐀𝐝𝐯𝐚𝐧𝐜𝐞𝐦𝐞𝐧𝐭𝐬 𝐚𝐧𝐝 𝐄𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐆𝐫𝐨𝐰𝐭𝐡

The Bitcoin ecosystem continues to evolve, with technological advancements and infrastructure developments making it more accessible and secure. The growth of the Lightning Network, for example, is enhancing Bitcoin's scalability and enabling faster, cheaper transactions.

𝐊𝐞𝐲 𝐈𝐧𝐧𝐨𝐯𝐚𝐭𝐢𝐨𝐧𝐬:

- Layer 2 Solutions: Technologies like the Lightning Network are addressing Bitcoin's scalability issues, making it more efficient for everyday transactions.

- Security Enhancements: Ongoing improvements in security protocols and custodial services are making Bitcoin a safer investment.

𝟒. 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐂𝐥𝐚𝐫𝐢𝐭𝐲 𝐚𝐧𝐝 𝐆𝐥𝐨𝐛𝐚𝐥 𝐈𝐧𝐭𝐞𝐠𝐫𝐚𝐭𝐢𝐨𝐧

Regulatory clarity is crucial for Bitcoin's mainstream adoption. As governments and regulatory bodies around the world develop clearer frameworks for cryptocurrency, investor confidence will grow, leading to increased participation.

𝐏𝐨𝐬𝐢𝐭𝐢𝐯𝐞 𝐑𝐞𝐠𝐮𝐥𝐚𝐭𝐨𝐫𝐲 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭𝐬:

- Pro-Crypto Legislation: Countries like El Salvador have adopted Bitcoin as legal tender, setting a precedent for other nations.

- Regulatory Support: In major financial hubs, regulators are creating favorable environments for crypto businesses, fostering innovation and adoption.

𝟓. 𝐌𝐚𝐜𝐫𝐨-𝐄𝐜𝐨𝐧𝐨𝐦𝐢𝐜 𝐓𝐫𝐞𝐧𝐝𝐬

Macro-economic factors, such as global economic uncertainty, inflation, and monetary policy, play a significant role in Bitcoin's potential growth. As traditional financial systems face challenges, Bitcoin's appeal as an alternative asset class strengthens.

𝐈𝐧𝐟𝐥𝐮𝐞𝐧𝐭𝐢𝐚𝐥 𝐓𝐫𝐞𝐧𝐝𝐬:

- Inflation Hedge: In an era of unprecedented money printing and rising inflation, Bitcoin's fixed supply offers a hedge against currency devaluation.

- Economic Instability: In times of economic crisis, Bitcoin's decentralized nature provides a stable alternative to traditional assets.

𝟔. 𝐁𝐢𝐭𝐜𝐨𝐢𝐧’𝐬 𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞 𝐚𝐧𝐝 𝐈𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐢𝐳𝐚𝐭𝐢𝐨𝐧

Bitcoin's resilience is often compared to that of a cockroach—it cannot be destroyed. Despite numerous challenges and attempts to undermine it, Bitcoin has shown an unparalleled ability to adapt and thrive.

This resilience is coupled with a unique incentivization mechanism that motivates individuals and organizations to contribute to its network.

𝐑𝐞𝐬𝐢𝐥𝐢𝐞𝐧𝐜𝐞 𝐚𝐧𝐝 𝐈𝐧𝐜𝐞𝐧𝐭𝐢𝐯𝐞𝐬:

- Unbreakable Nature: Bitcoin's decentralized architecture makes it nearly impossible to be taken down by any single entity.

- Economic Incentives: Miners and developers are financially motivated to secure and improve the Bitcoin network, ensuring its continual growth and robustness.

𝟕. 𝐃𝐢𝐯𝐢𝐬𝐢𝐛𝐢𝐥𝐢𝐭𝐲 𝐨𝐟 𝐁𝐢𝐭𝐜𝐨𝐢𝐧

One of the remarkable features of Bitcoin is its divisibility. Each Bitcoin can be divided into 100 million smaller units called "Satoshis."

This divisibility ensures that even as Bitcoin's price rises, it remains accessible for transactions of all sizes. This characteristic is essential for the broader adoption and usability of Bitcoin in everyday transactions.

𝟖. 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐯𝐬. 𝐄𝐭𝐡𝐞𝐫𝐞𝐮𝐦 𝐚𝐧𝐝 𝐎𝐭𝐡𝐞𝐫 𝐂𝐫𝐲𝐩𝐭𝐨𝐜𝐮𝐫𝐫𝐞𝐧𝐜𝐢𝐞𝐬

While numerous cryptocurrencies have emerged since Bitcoin, each with its unique features and use cases, Bitcoin maintains a distinct position as the market leader.

Understanding why Bitcoin, as opposed to Ethereum or other coins, has the potential to reach $700,000 is crucial for investors.

𝐁𝐢𝐭𝐜𝐨𝐢𝐧’𝐬 𝐔𝐧𝐢𝐪𝐮𝐞 𝐀𝐝𝐯𝐚𝐧𝐭𝐚𝐠𝐞𝐬:

- First-Mover Advantage: As the first cryptocurrency, Bitcoin enjoys widespread recognition and trust, which newer cryptocurrencies have yet to achieve.

- Simplicity and Security: Bitcoin's primary function as a store of value and medium of exchange simplifies its use case, making it a more straightforward investment. Its proof-of-work consensus mechanism

- Decentralization: Bitcoin is the most decentralized cryptocurrency, with no central authority controlling its network. This decentralization is critical for its resilience and trustworthiness.

- Store of Value: While Ethereum offers smart contract functionality and supports decentralized applications (dApps), Bitcoin's focus on being a store of value akin to digital gold makes it a more stable and attractive long-term investment.

Comparative Analysis:

- Ethereum: Known for its smart contracts and dApps, Ethereum has a broader technological scope but also faces more significant scalability and security challenges. Its recent shift to proof-of-stake (Ethereum 2.0) aims to address these issues but also introduces new complexities and risks.

- Altcoins: Other cryptocurrencies like Cardano, Solana, and Polkadot offer innovative solutions and improvements over Bitcoin and Ethereum. However, they are still in earlier stages of adoption and face significant competition and regulatory scrutiny.

The Road to $700K

While predicting Bitcoin's future with absolute certainty is impossible, the convergence of institutional adoption, technological advancements, regulatory clarity, macroeconomic trends, Bitcoin’s inherent resilience, incentivization mechanisms, and divisibility creates a compelling case for its continued growth.

As Bitcoin matures and integrates further into the global financial system, reaching $700,000 per coin in the next decade is not just a possibility but a realistic projection.

For investors and enthusiasts, staying informed and engaged with these developments will be crucial as we navigate this exciting journey to an unprecedented financial milestone.

#Bitcoin #Cryptocurrency #Blockchain #CryptoInvesting #DigitalGold #BitcoinAdoption #CryptoRegulation #FinancialInnovation #Decentralization #BTCto700K #BitcoinFuture #BitcoinResilience #CryptoMarket #BitcoinNews #CryptoEconomy #BTCPricePrediction #BitcoinVsEthereum #CryptoCommunity #HODL #BitcoinMillionaires #AssetClass #benzeno #soldhere #REIGNation

Share This Post

💬 Join the Discussion

Have thoughts on this article? Share them below! Sign in with your GitHub account to leave a comment.

More Posts

View All Posts

Had You Heard of Notion? Have You Used It? It is the early shape of the cognitive work

Discover the true power of Notion as an all-in-one collaborative workspace platform. Learn how it revolutionizes knowled...

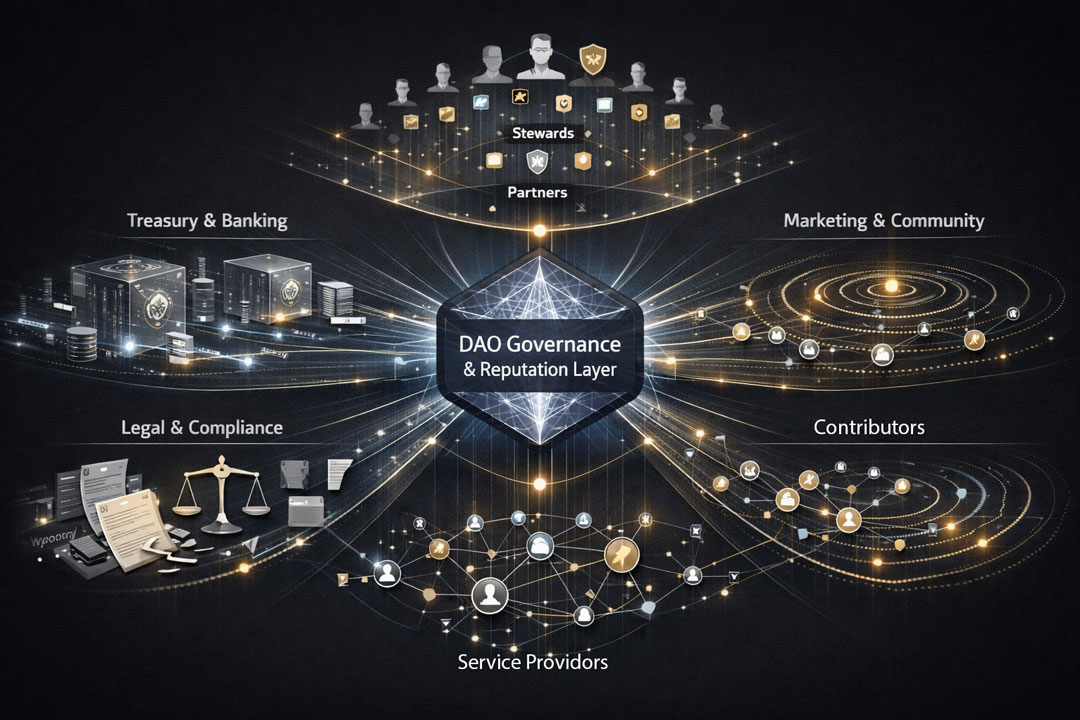

The Future of Work is Here: DAO-Firms and the Automation of Trust

Explore how DAO-Firms will reshape traditional companies in the future of work. Learn about the automation of trust and ...

Mini Nuclear Reactors (SMRs): Deep Dive into Key Players, Tech & Market Trends

Small modular reactors (SMRs) and microreactors – essentially “mini” nuclear power plants – are gaining momentum as a ca...

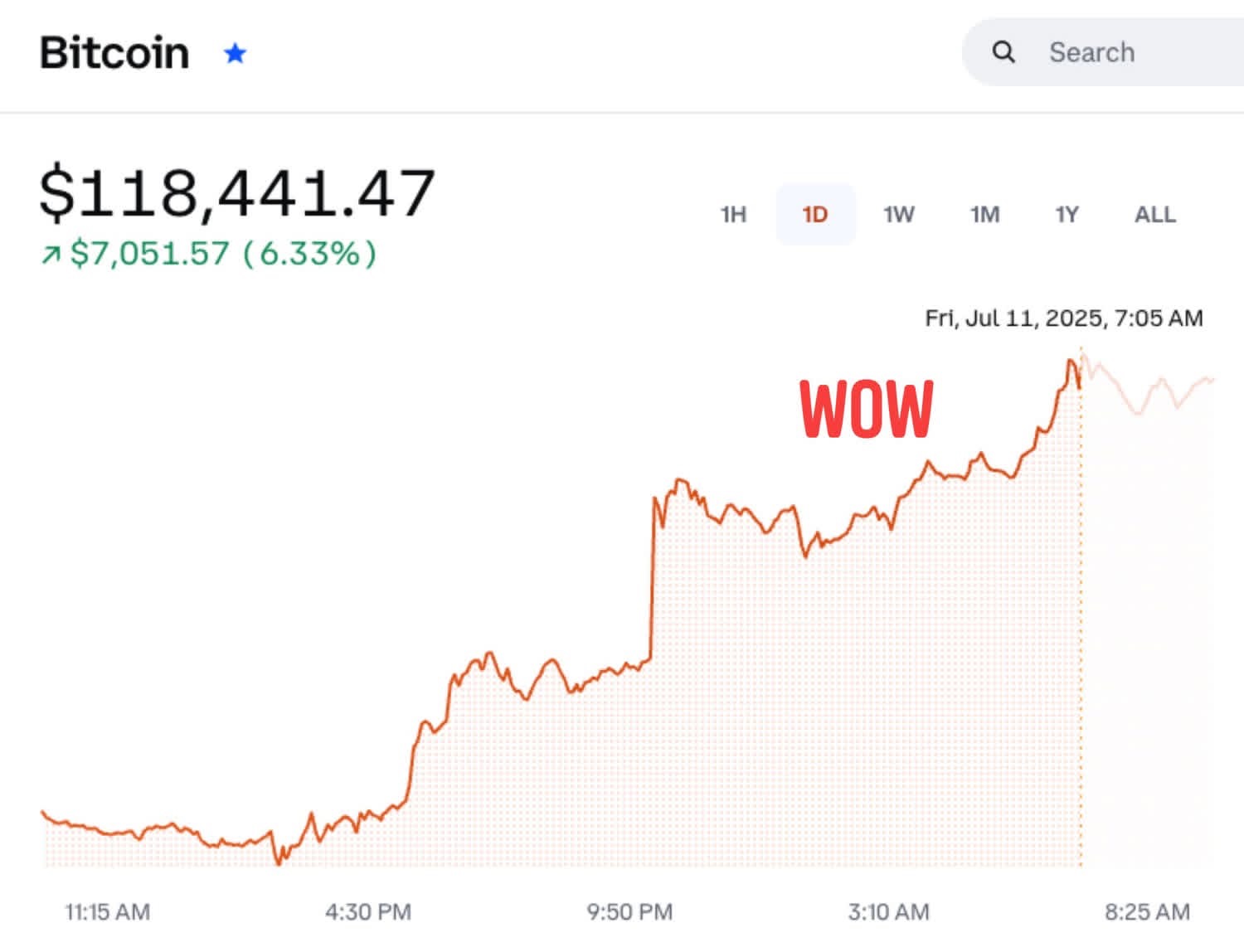

Bitcoin’s 24‑Hour Price Explosion: Decoding the Breakout and the Road Ahead

Discover the reasons behind Bitcoin's 24-hour price explosion to a new all-time high of $118,500. Explore the market ana...

AI Acceleration, the "Power Race," and Near-Term Societal Shock Risk Through 2035 (Part 1: Short-Term Vision)

The full unabridged deep research report - Part 1, Short-Term Vision: AI acceleration, the power race, and societal shoc...

Hydrogen Energy: Storage for Renewable Energy

Discover the different types of hydrogen energy - green, blue, and white - and how they are powering the global green re...