Is Tesla Stock on the Road to $500?

Is Tesla Stock on the Road to $500?

A Strategic Look at Potential Gains and Shorting Opportunities

The future of Tesla's stock is a hot topic among investors and enthusiasts alike. With the imminent deployment of Tesla’s Full Self-Driving (FSD) technology, there is growing buzz about the potential for Tesla’s stock to reach new heights, possibly hitting the $500 mark. Here’s a closer look at the factors that could drive this upward trajectory and an additional strategy involving Uber and Lyft stocks.

Full Self-Driving (FSD) Readiness and Deployment

Tesla has been aggressively developing its FSD technology. If the company successfully rolls out this autonomous driving feature and proves reliable, it could revolutionize the transportation industry. The FSD technology promises to enhance vehicle safety and functionality while paving the way for Tesla's ambitious Robotaxi network. This network could generate substantial recurring revenue as Tesla vehicle owners opt to include their cars in the autonomous fleet, earning income when their cars are not in personal use.

Increasing Sales Through Additional Revenue Streams

Tesla's Robotaxi network not only provides a new revenue stream for the company but also incentivizes vehicle purchases. Existing Tesla owners can participate in the Robotaxi network without needing additional hardware, as all Tesla vehicles produced since 2016 are equipped with the necessary hardware for full autonomy. This accessibility makes it easier for owners to take advantage of the Robotaxi service, potentially increasing Tesla's vehicle sales as new buyers are attracted by the opportunity to generate income from their cars.

Financial Performance and Market Growth

Tesla's financial performance has been robust, with consistent revenue growth and strong profit margins. The successful deployment of FSD technology is expected to further boost revenue through FSD subscriptions and higher vehicle sales due to the added autonomous features. Moreover, the electric vehicle (EV) market is expanding rapidly, driven by environmental concerns and government incentives. As a leader in this space, Tesla is well-positioned to capitalize on this growth.

Analyst Projections and Investor Sentiment

Market analysts have a generally positive outlook on Tesla's stock, especially with the potential deployment of its self-driving technology. Positive analyst ratings and increased price targets can drive investor confidence, leading to higher demand for Tesla stock. If the FSD technology is deployed smoothly and regulatory approvals are obtained, it could significantly enhance Tesla's valuation, pushing the stock price toward $500.

Potential Risks

While the prospects are promising, there are inherent risks. Technological challenges, regulatory hurdles, and increasing competition could impact Tesla's ability to deploy its self-driving technology and maintain market dominance. These factors need to be carefully monitored.

Considering the Shorting Strategy for Uber and Lyft

With Tesla's advancements in autonomous driving, there's a strong case for considering short positions on Uber and Lyft. Here's why:

Impact on Uber and Lyft

Revenue and Market Share:

Tesla’s Robotaxi network could offer rides at lower costs due to the elimination of driver expenses, attracting cost-sensitive customers and potentially eroding the market share of Uber and Lyft.

Operational Costs:

Autonomous vehicles reduce the need for human drivers, significantly lowering operational costs. Tesla's electric vehicles also have lower maintenance costs than traditional internal combustion engines.

Competitive Pricing:

With Tesla’s cost advantages, they could offer competitive pricing, making it difficult for Uber and Lyft to match while maintaining their profit margins.

Expected Stock Price Impact

If Tesla announces the deployment of its self-driving technology and Robotaxi network in August, Uber and Lyft could see significant declines in their stock prices due to the anticipated competitive threat. For instance, Uber's current stock price is around $71.06. Assuming a 20% decline in response to Tesla’s announcement, Uber's stock could drop to approximately $56.85.

Options Strategy to Capitalize on These Movements

As an options market specialist, you can devise a strategy to capitalize on the expected movements in Tesla, Uber, and Lyft stocks:

Bullish Strategy for Tesla

Long Call Option:

Objective: Profit from the anticipated rise in Tesla's stock price.

Strategy: Buy call options on Tesla (TSLA) to gain leverage and maximize potential returns.

Example:

Purchase TSLA call options with a strike price of $500 and an expiration date several months out (e.g., January 2025).

Bearish Strategy for Uber and Lyft

Long Put Option:

Objective: Profit from the anticipated decline in Uber (UBER) and Lyft (LYFT) stock prices.

Strategy: Buy put options on Uber and Lyft to gain leverage and maximize potential returns from the decline.

Example:

Purchase UBER and LYFT put options with a strike price 20% below the current price (e.g., $56 for UBER if it’s currently at $71.06) with an expiration date several months out.

Conclusion

Investing in Tesla offers a promising opportunity as the company continues to innovate and lead in the EV and autonomous driving sectors. With the potential for Tesla's stock to reach $500, it's a compelling investment. Additionally, considering short positions on Uber and Lyft could further enhance gains by capitalizing on the competitive pressures Tesla’s advancements will likely impose on these companies.

Sources

- The Verge

- Electrek

- MarketBeat

- Bloomberg

HashTags

#Tesla #TeslaStock #EVs #FullSelfDriving #FSD #Robotaxi #AutonomousDriving #ElectricVehicles #StockMarket #InvestmentStrategy #OptionsTrading #TechStocks #TeslaInnovation #ElonMusk #TeslaFSD #FinancialPerformance #Uber #Lyft #ShortingStocks #MarketGrowth #InvestorSentiment #eytan #benzeno

Share This Post

💬 Join the Discussion

Have thoughts on this article? Share them below! Sign in with your GitHub account to leave a comment.

More Posts

View All Posts

Had You Heard of Notion? Have You Used It? It is the early shape of the cognitive work

Discover the true power of Notion as an all-in-one collaborative workspace platform. Learn how it revolutionizes knowled...

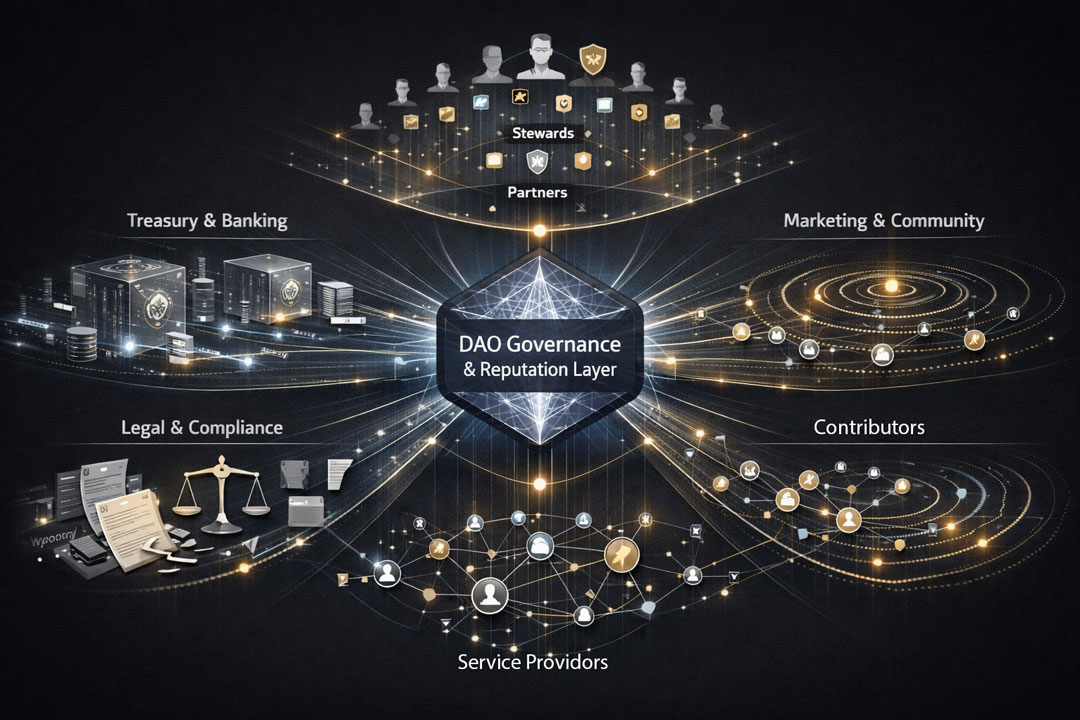

The Future of Work is Here: DAO-Firms and the Automation of Trust

Explore how DAO-Firms will reshape traditional companies in the future of work. Learn about the automation of trust and ...

Mini Nuclear Reactors (SMRs): Deep Dive into Key Players, Tech & Market Trends

Small modular reactors (SMRs) and microreactors – essentially “mini” nuclear power plants – are gaining momentum as a ca...

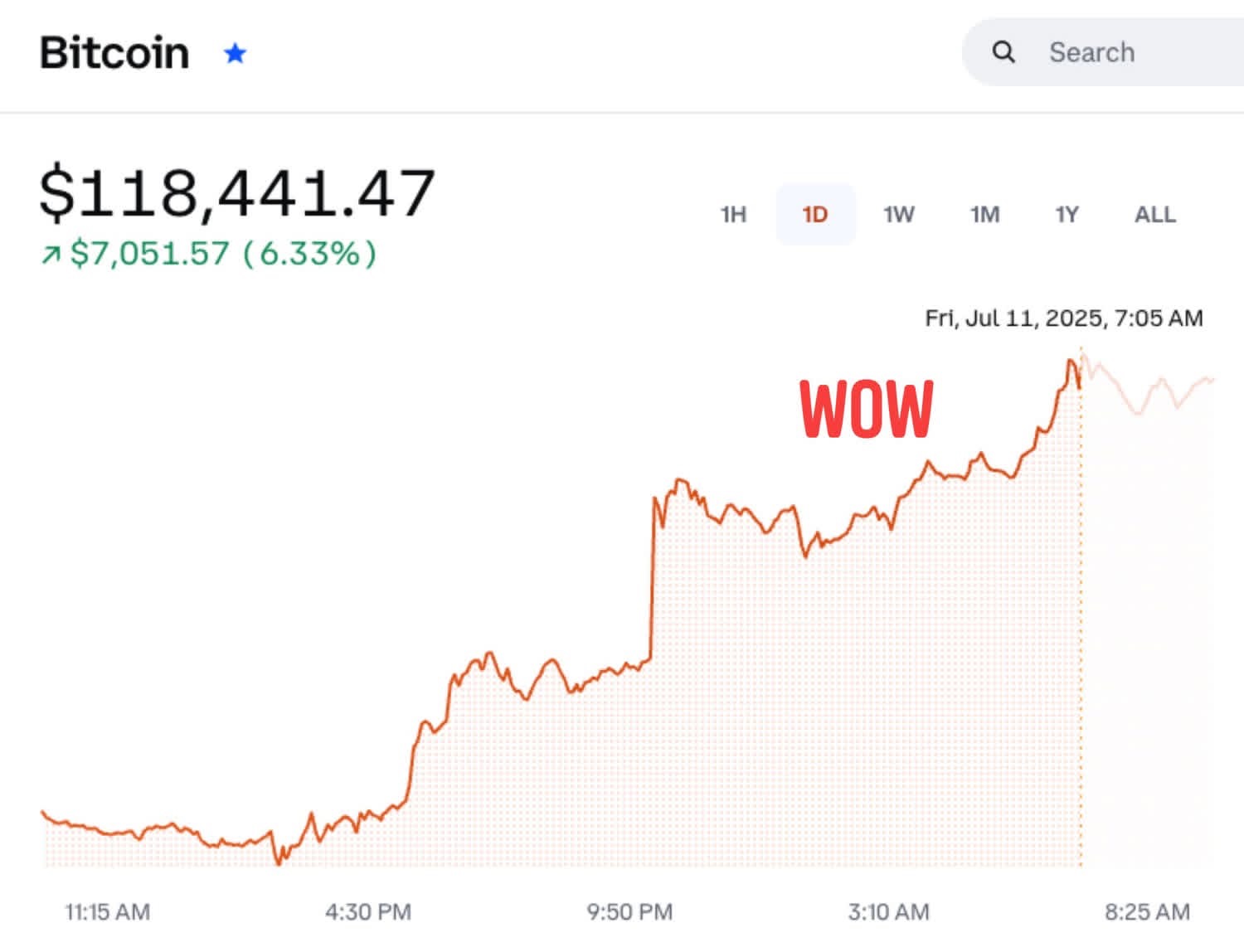

Bitcoin’s 24‑Hour Price Explosion: Decoding the Breakout and the Road Ahead

Discover the reasons behind Bitcoin's 24-hour price explosion to a new all-time high of $118,500. Explore the market ana...

Bitcoin to $700K: The Path to an Unprecedented Financial Milestone

Explore the potential of Bitcoin to reach $700K and its impact on the financial world. Learn about key factors driving B...

AI Acceleration, the "Power Race," and Near-Term Societal Shock Risk Through 2035 (Part 1: Short-Term Vision)

The full unabridged deep research report - Part 1, Short-Term Vision: AI acceleration, the power race, and societal shoc...